For the 24 hours to 23:00 GMT, the EUR declined 0.14% against the USD and closed at 1.1384.

In economic news, Germany’s seasonally adjusted factory orders advanced above expectations by 1.9% MoM in March, its biggest rise in nine months, compared to market expectations for a rise of 0.6%. Factory orders had dropped by a revised 0.8% in the previous month. Moreover, the Eurozone’s Sentix investor confidence index rose more-than-expected to a 4-month high level of 6.2 in May, compared to market expectations of a rise to a level of 6.0. In the prior month, the index had recorded a reading of 5.7.

In the US, the labour market conditions index declined less-than-expected to a level of 0.9 in April, after registering a reading of -2.1 in the previous month. Investors had expected it to fall to a level of 1.0.

Separately, the Chicago Fed President, Charles Evans, indicated that the US Federal Reserve’s ‘wait and see’ monetary policy approach is appropriate to ensure that the nation’s economic growth continues.

In the Asian session, at GMT0300, the pair is trading at 1.1378, with the EUR trading marginally lower from yesterday’s close.

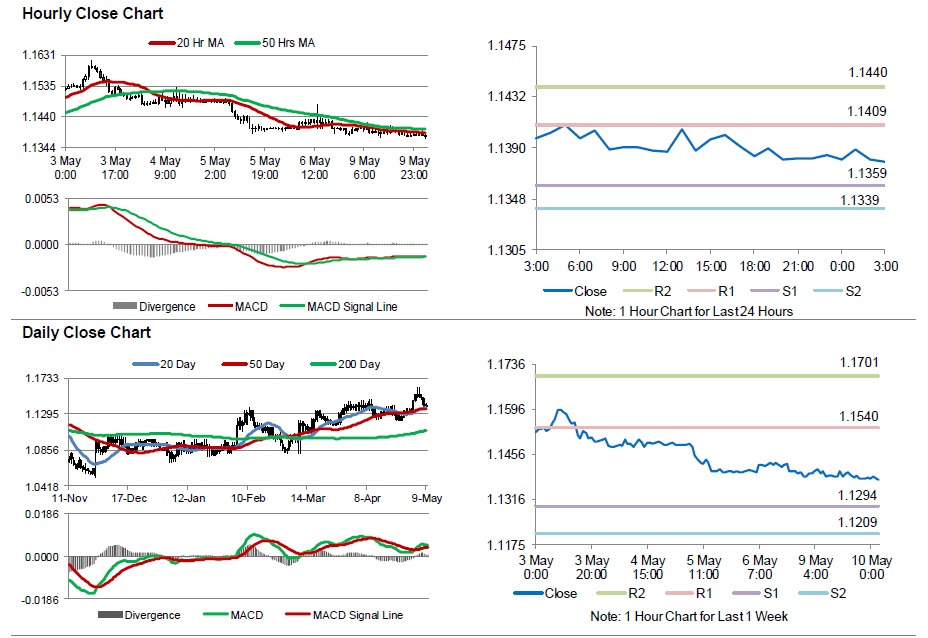

The pair is expected to find support at 1.1359, and a fall through could take it to the next support level of 1.1339. The pair is expected to find its first resistance at 1.1409, and a rise through could take it to the next resistance level of 1.1440.

Going ahead, investors will look forward to Germany’s trade balance and industrial production data, both for the month of March, scheduled to release in a few hours. Additionally, the US NFIB business optimism index data for April will also attract market attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.