For the 24 hours to 23:00 GMT, the EUR declined 0.61% against the USD and closed at 1.0863.

In economic news, German factory orders rose more-than-expected by 1.8% MoM in October, advancing for the first time in four months, against market expectations for a 1.2% increase and after declining by a revised 0.7% in the previous month.

Separately, the ECB President, Mario Draghi, defended the central bank’s latest stimulus package and stated that the ECB will not hesitate to ease its policy further, if needed, in order to boost inflation toward its 2.0% goal.

The greenback gained ground, after the release of a stronger-than-expected US non-farm payrolls data in November. Data showed that the US non-farm payrolls advanced by 211.0K in November, more than market anticipations of an advance of 200.0K after recording a revised gain of 298.0K in the previous month. Also, the nation’s unemployment rate remained steady at a 5.0% during the same month, at par with market expectations.

On the other hand, the US trade deficit widened to $43.9 billion in October, following a revised trade deficit of $42.5 billion in the previous month. Markets were anticipating the nation to post a deficit of $40.5 billion.

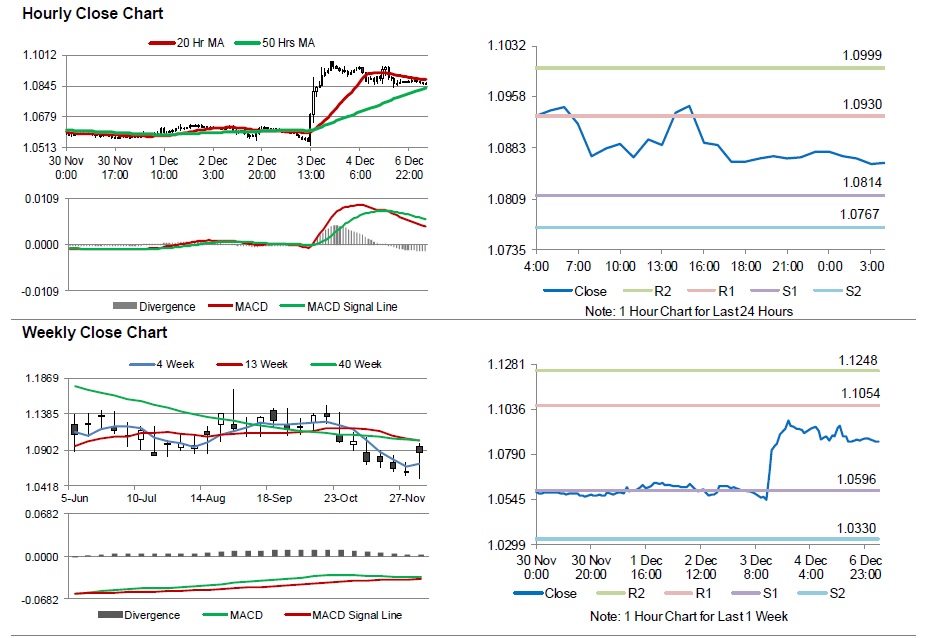

In the Asian session, at GMT0400, the pair is trading at 1.0861, with the EUR trading marginally lower from Friday’s close.

The pair is expected to find support at 1.0814, and a fall through could take it to the next support level of 1.0767. The pair is expected to find its first resistance at 1.093, and a rise through could take it to the next resistance level of 1.0999.

Going ahead, market participants will look forward to Germany’s industrial production data for October, scheduled to be released in a few hours. Additionally, investors will also concentrate on the US labour market conditions index and consumer credit change data, due later today.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.