For the 24 hours to 23:00 GMT, the EUR declined 0.48% against the USD and closed at 1.1300, after,

Germany’s producer price index remained flat on a monthly basis in March, its steepest decline since January 2010, compared to market expectations for a rise of 0.2%. In the prior month, the producer price index had recorded a drop of 0.5%.

The greenback gained ground, after data showed that US existing home sales rebounded more-than-anticipated by 5.1% MoM in March to a level of 5.3 million, compared to market expectations of a 3.5% rise. In the previous month, home sales had declined by 7.1%. Additionally, the nation’s mortgage applications rose for the third consecutive week by 1.3% in the week ended 15 April 2016, marking its highest level in nine weeks. Mortgage applications had risen 10.0% in the previous week.

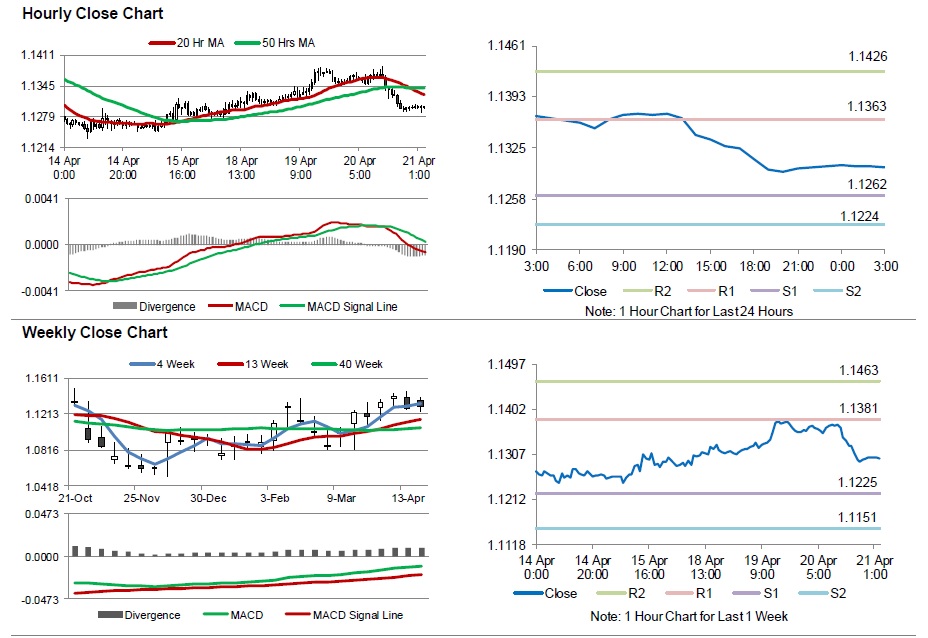

In the Asian session, at GMT0300, the pair is trading at 1.13, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.1262, and a fall through could take it to the next support level of 1.1224. The pair is expected to find its first resistance at 1.1363, and a rise through could take it to the next resistance level of 1.1426.

Going ahead, market participants will keenly look forward to the ECB interest rate decision, scheduled to be announced later in the day. Moreover, the US initial jobless claims and housing price index data, due later today, will also garner a lot of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.