For the 24 hours to 23:00 GMT, the EUR traded tad lower against the USD and closed at 1.2923.

In economic news, Germany, the Euro-zone’s biggest economy, registered a flat CPI data, in line with market expectations, on a monthly basis in August. Elsewhere, French EU normalized CPI climbed 0.5%, on a monthly basis in August, beating market expectations for a 0.4% rise and compared to a drop of 0.4% in the previous month.

Yesterday, the ECB, in its monthly report, reported that the policymakers would keep a close eye on the risks surrounding the outlook for inflation in the Euro-zone and would take all the necessary measures to maintain its inflation target. Furthermore, it reiterated that geopolitical tensions in Eastern Europe continued to weigh on the region’s economic growth. Separately, the ECB Chief, Mario Draghi, urged the Euro-member nations to increase their investment in the single currency-bloc, in order to bring back the Euro-zone to the pre-crisis level and stimulate growth. Additionally, the ECB Governing Council Member, Christian Noyer, stated that even though the ECB succeeded in bringing down the Euro, the central bank still needs to bring the currency further down, in order to achieve the inflation target.

In the US, the number of initial jobless claims unexpectedly advanced to a level of 315K in the week ended 06 September 2014, higher than market expectations to fall to a level of 300K, following a revised level of 304K. However, continuing jobless claims in the nation rose to 2,487K, in the week ended 30 August 2014, against market expectations for a rise to a level of 2,490K and compared to a level of 2,478K in the preceding week. Meanwhile, the US budget deficit expanded to $128.7 billion in August, following a deficit of $94.6 billion in July.

In the Asian session, at GMT0300, the pair is trading at 1.2916, with the EUR trading marginally lower from yesterday’s close.

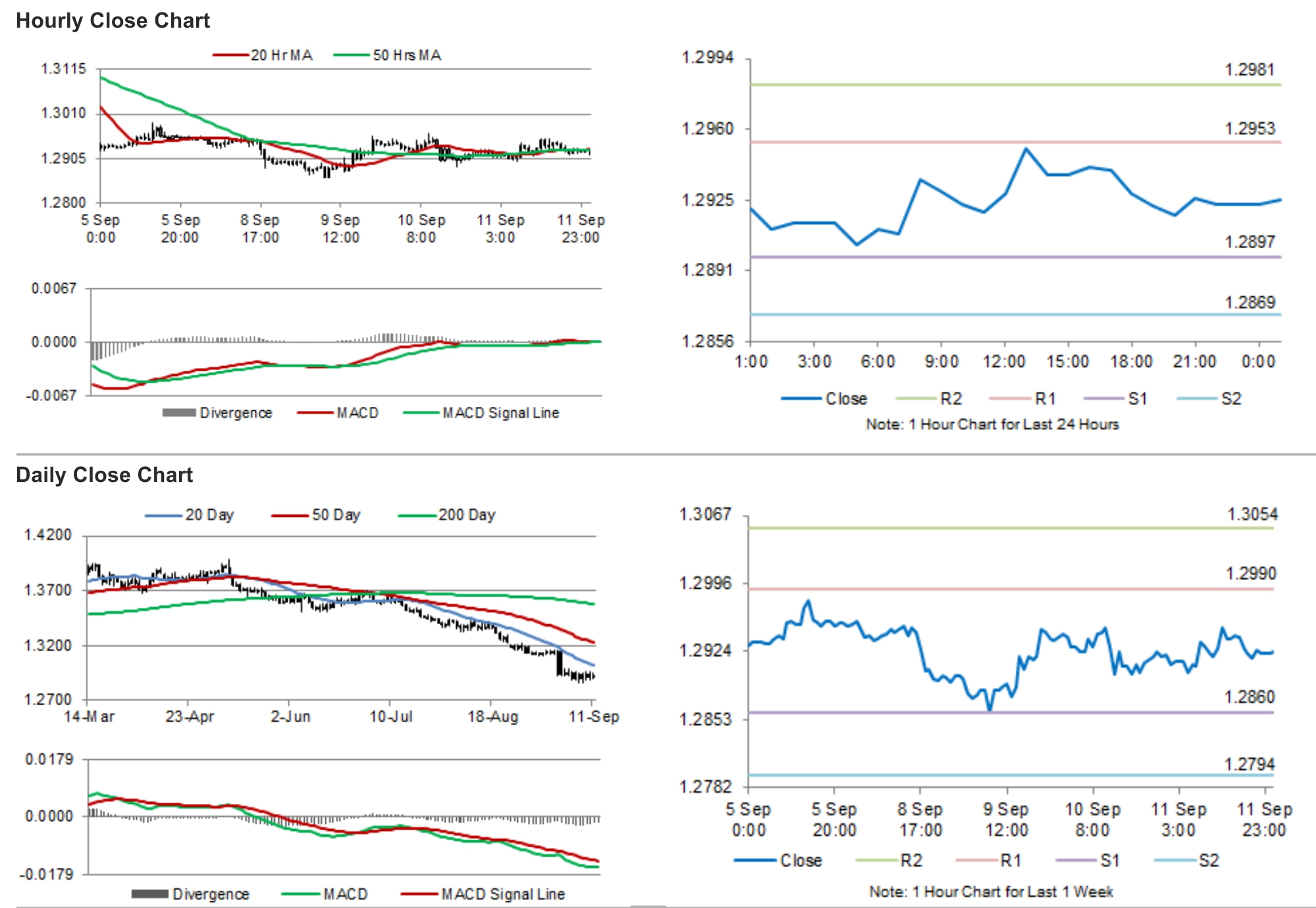

The pair is expected to find support at 1.2891, and a fall through could take it to the next support level of 1.2866. The pair is expected to find its first resistance at 1.2947, and a rise through could take it to the next resistance level of 1.2978.

Trading trends in the pair today are expected to be determined by the Euro-zone’s employment as well as industrial production data, scheduled in a few hours. Meanwhile, investors would also keep a close watch on the US retail sales and consumer confidence data, scheduled later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.