For the 24 hours to 23:00 GMT, EUR rose 0.28% against the USD and closed at 1.4485, dented by speculation that Greece and possibly Ireland may be forced to restructure their massive debts, pushing peripheral Euro-zone bond yields higher.

In the US, the initial jobless claims rose to 412000 for the week ended on 9 April 2011. Meanwhile, continuing jobless claims were down to 3.68 million compared to the preceding week’s level of 3.738 million.

The European Central Bank (ECB) in its April monthly bulletin indicated that it sees “upside risks†to price stability in the medium term and will continue to monitor inflation “very closelyâ€. The central bank further added that its monetary policy stance “remains accommodativeâ€.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4471, 0.10% lower from the levels yesterday at 23:00GMT.

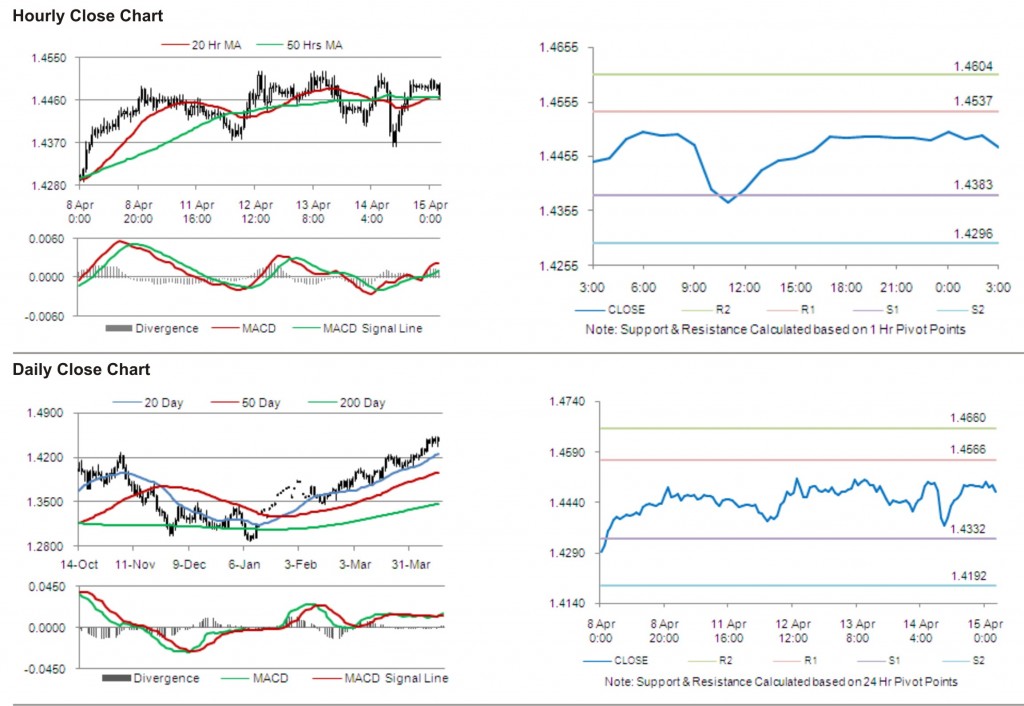

The pair has its first short term resistance at 1.4537, followed by the next resistance at 1.4604. The first support is at 1.4383, with the subsequent support at 1.4296.

Trading trends in the pair today are expected to be determined by data release on consumer price index and trade balance in the Euro zone.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.