For the 24 hours to 23:00 GMT, EUR declined 0.47% against the USD, on Friday and closed at 1.4417, amid concern the European sovereign debt crisis is worsening and as policy makers stepped up efforts to cool inflation globally.

The euro came under pressure on Friday after Moody’s cut its credit rating on Ireland by two notches to just above junk status, citing an “expected decline” in government finances that is set to hamper the nation’s recovery. Sentiment worsened after the Wall Street Journal reported over the weekend that the International Monetary Fund believes Greece’s debt is unsustainable.

In the EU, consumer price index, on monthly basis, increased by 1.4% in March, while the core-inflation, which excludes prices of energy and food, rose by 1.3% in March, up from the previous increase of 1.0%. Additionally, the trade deficit in the Euro-zone narrowed to €1.5 billion in February, following a deficit of €15.6 billion recorded in January.

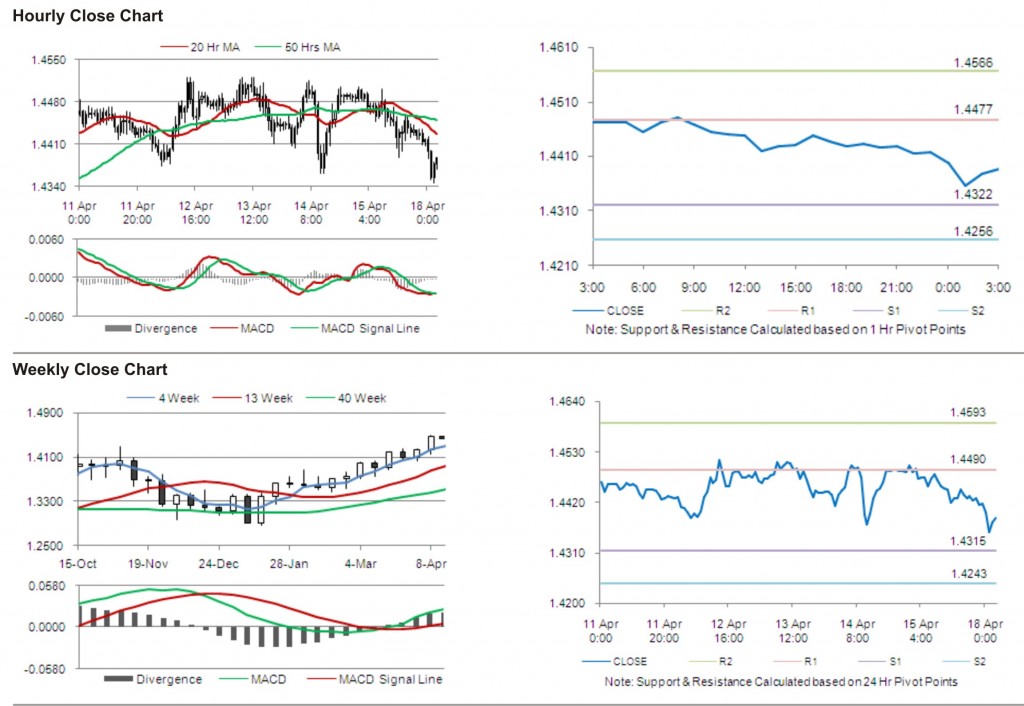

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4387, 0.21% lower from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.4477, followed by the next resistance at 1.4566. The first support is at 1.4322, with the subsequent support at 1.4256.

Trading trends in the pair today are expected to be determined by data release on consumer confidence in the Euro zone.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.