For the 24 hours to 23:00 GMT, EUR rose 0.57% against the USD and closed at 1.3131, amid renewed optimism over Greece, after reports indicated that the European Central Bank (ECB), would swap its holdings of Greek bonds for new Greek bonds by Monday.

Adding to optimism, France sold €8.45 billion of debt at lower borrowing costs, and Spain successfully raised €4.07 billion at a bond auction maturing in 2015 and 2019.

Meanwhile, in its monthly bulletin, the European Central Bank (ECB), stated that there were tentative signs of stabilisation in economic activity, but the economic outlook remains subject to high uncertainty and downside risks.

In the Asian session, at GMT0400, the pair is trading at 1.3132, with the EUR trading steady from yesterday’s close.

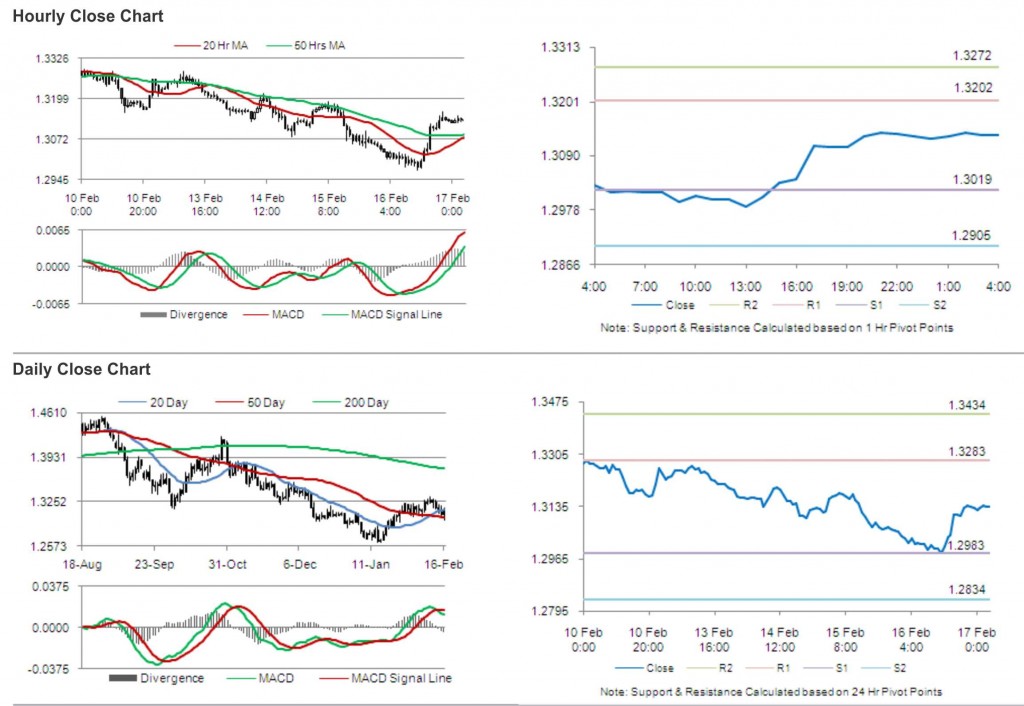

The pair is expected to find support at 1.3019, and a fall through could take it to the next support level of 1.2905. The pair is expected to find its first resistance at 1.3202, and a rise through could take it to the next resistance level of 1.3272.

With a series of the Euro-zone economic releases today, including current account and Services PMI, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.