For the 24 hours to 23:00 GMT, the EUR declined 0.18% against the USD and closed at 1.2155, as investor sentiment was dented after Greece’s Prime Minister Antonis Samaras was unsuccessful in his third and final attempt to coax parliament to support his candidate, Stavros Dimas, for Head of State, thereby leading to an early parliamentary election.

Meanwhile, the EU’s Economic Commissioner, Pierre Moscovici cautioned that a “strong commitment to Europe and broad support among the Greek voters and political leaders for the necessary growth-friendly reform process will be essential for Greece to thrive again within the Euro area.” Similarly, German Finance Minister Wolfgang Schäuble too urged Greece to stick to its earlier agreed economic reforms irrespective of the results of a snap election due next month.

In another noteworthy development, the IMF stopped its financial aid to Greece until the creation of a new government in the debt-ridden country. However, the fund assured that its latest move would not hamper the nation’s uncertain economy as “Greece faces no immediate financing needs.”

On the economic front, confidence among consumers in Italy fell to a 10-month low level of 99.7 in December, from previous month’s level of 100.2.

In the US, the Dallas Fed manufacturing business index slumped to 4.10 in December, compared to a reading of 10.50 in the prior month. Market anticipations were for the Dallas Fed manufacturing business index to drop to 9.00.

In the Asian session, at 4:00GMT, the EUR is trading at 1.2139, 0.13% lower against USD, from the levels yesterday at 23:00GMT.

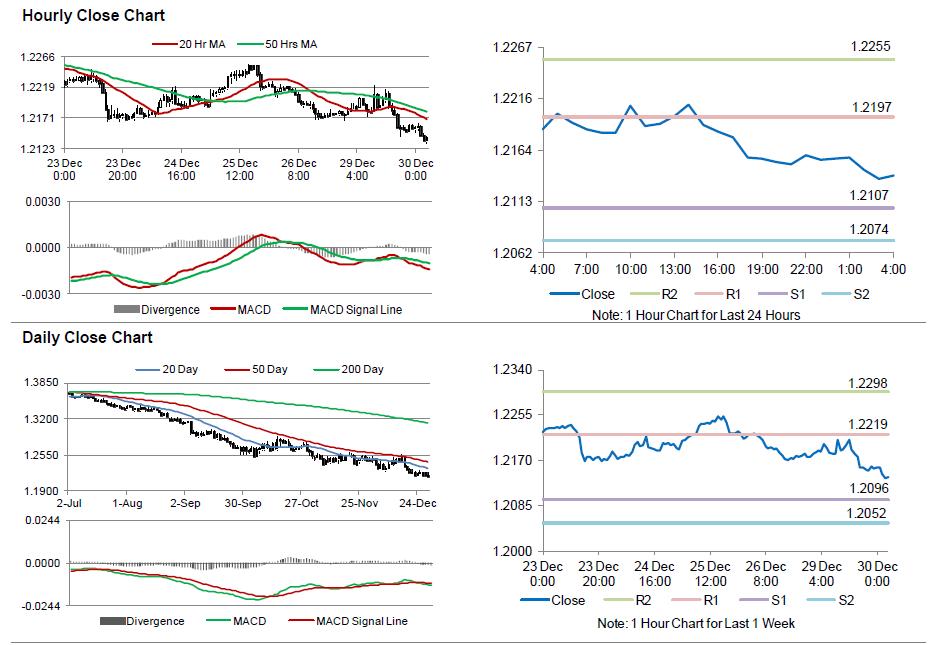

The pair is expected to find support at 1.2107, and a fall through could take it to the next support level of 1.2074. The pair is expected to find its first resistance at 1.2197, and a rise through could take it to the next resistance level of 1.2255.

Trading trends in the pair today are expected to be determined by the consumer confidence data from the US. Meanwhile, investors would also pay attention to the release of money supply and private loans data from the Euro-zone along with retail sales numbers from Spain.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.