For the 24 hours to 23:00 GMT, the EUR declined 0.31% against the USD and closed at 1.0883, after Euro-zone’s preliminary consumer prices dropped back into deflation.

Data showed that the region’s consumer price index unexpectedly fell by 0.2% YoY in February, entering into negative territory for the first time since September 2015, thus adding to speculation that the ECB would announce further monetary stimulus next week. Markets expected it to record a flat reading. The index had risen 0.3% in the previous month.

Another set of data showed that Germany’s retail sales rose by 0.7% MoM in January, beating investor expectations for a rise of 0.3% and compared to a revised gain of 0.6% in the previous month, indicating that domestic consumption kept the Euro-zone’s biggest economy relatively strong.

In the US, pending home sales unexpectedly eased by 2.5% MoM in January, registering its lowest reading in a year, after recording a revised increase of 0.9% in the preceding month and compared to market expectations for an advance of 0.5%. Additionally, the Chicago Fed purchasing managers index dropped to a level of 47.60, compared to market expectations of a fall to a level of 52.5. It had registered a reading of 55.6 in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.0879, with the EUR trading marginally lower from yesterday’s close.

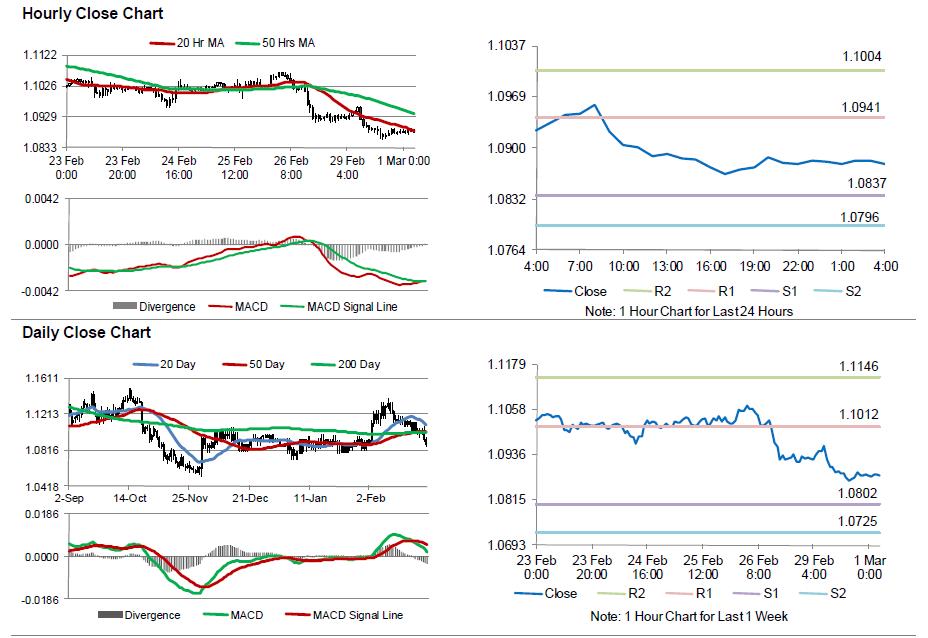

The pair is expected to find support at 1.0837, and a fall through could take it to the next support level of 1.0796. The pair is expected to find its first resistance at 1.0941, and a rise through could take it to the next resistance level of 1.1004.

Moving ahead, market participants await the release of unemployment rate and Markit manufacturing PMI data across the Euro-zone scheduled in a few hours for further cues. Additionally, the US ISM manufacturing PMI and Markit manufacturing PMI data for February, slated to be released later today, will garner a lot of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.