For the 24 hours to 23:00 GMT, EUR rose 0.19% against the USD and closed at 1.3707.

The US Dollar declined against the Euro-zone’s common currency pressurised by a lacklustre weekly US jobless claims data and following comments from the Fed Chief, Janet Yellen.

Janet Yellen, in her testimony before the Senate Banking Committee, opined that unusual cold weather in the US has played some role in the recent deterioration of economic data, but at the same time also stated that central bank is yet to “discern how much of the slowdown is related to weather”. Furthermore, she reiterated that the central bank would continue with the current pace of tapering its QE measure in its upcoming policy meeting even if recovery in the labour market shows some slackness. Negative sentiment in the dollar was also fuelled after the Atlanta Fed President, Dennis Lockhart, anticipated that interest rate in the nation would remain low for “quite a while” and indicated the possibility for a hike in interest rate only by the mid-2015. However, the greenback found some support from comments of the Dallas Fed President, Richard Fisher, who hinted that a prolonged accommodative policy could create unnecessary risks in the economy and urged the central bank to continue with its tapering at the current pace of $10 billion at each policy meeting. However, he added that if the economic growth in the US gains momentum, then the Fed could think about accelerating its pace of tapering its stimulus package.

On the economic front, initial jobless claims in the US rose more-than-expected by 14,000 to 348,000 in the week ended 21 February, from 334,000 claims recorded in the previous week. Meanwhile, the US durable goods orders registered a 1.0% fall in January, less than market expectations for a 1.6% fall and compared to a 5.3% drop registered in December.

In the Euro-zone, the ECB President, Mario Draghi clarified that at present there exists no deflation in the region, but vowed that in case potential downside risks to price stability arises, the central bank would act immediately. Separately, an ECB Governing Council member, Klaas Knot stated that the Euro-zone crisis is over from the financial markets but at the same time also warned that underlying weaknesses still persists in the bloc. Meanwhile, another ECB Governing Council member, Bostjan Jazbec expressed uncertainty if a mere rate cut could be a right move to boost lending in the region.

In economic news, consumer confidence in the Euro-zone fell in line with market expectations to a reading of -12.7 in February, from previous month’s figure of -11.7. Meanwhile, the economic sentiment indicator unexpectedly rose to a figure of 101.2 in February, the highest level since July 2011, from a reading of 101.0 recorded in the preceding month. Separately, data from Germany showed that unemployment rate in the nation stood pat at previous month’s level of 6.8% while the annual inflation rate in the nation declined to its lowest level in 3-1/2 years in February.

In the Asian session, at GMT0400, the pair is trading at 1.3701, with the EUR trading marginally lower from yesterday’s close.

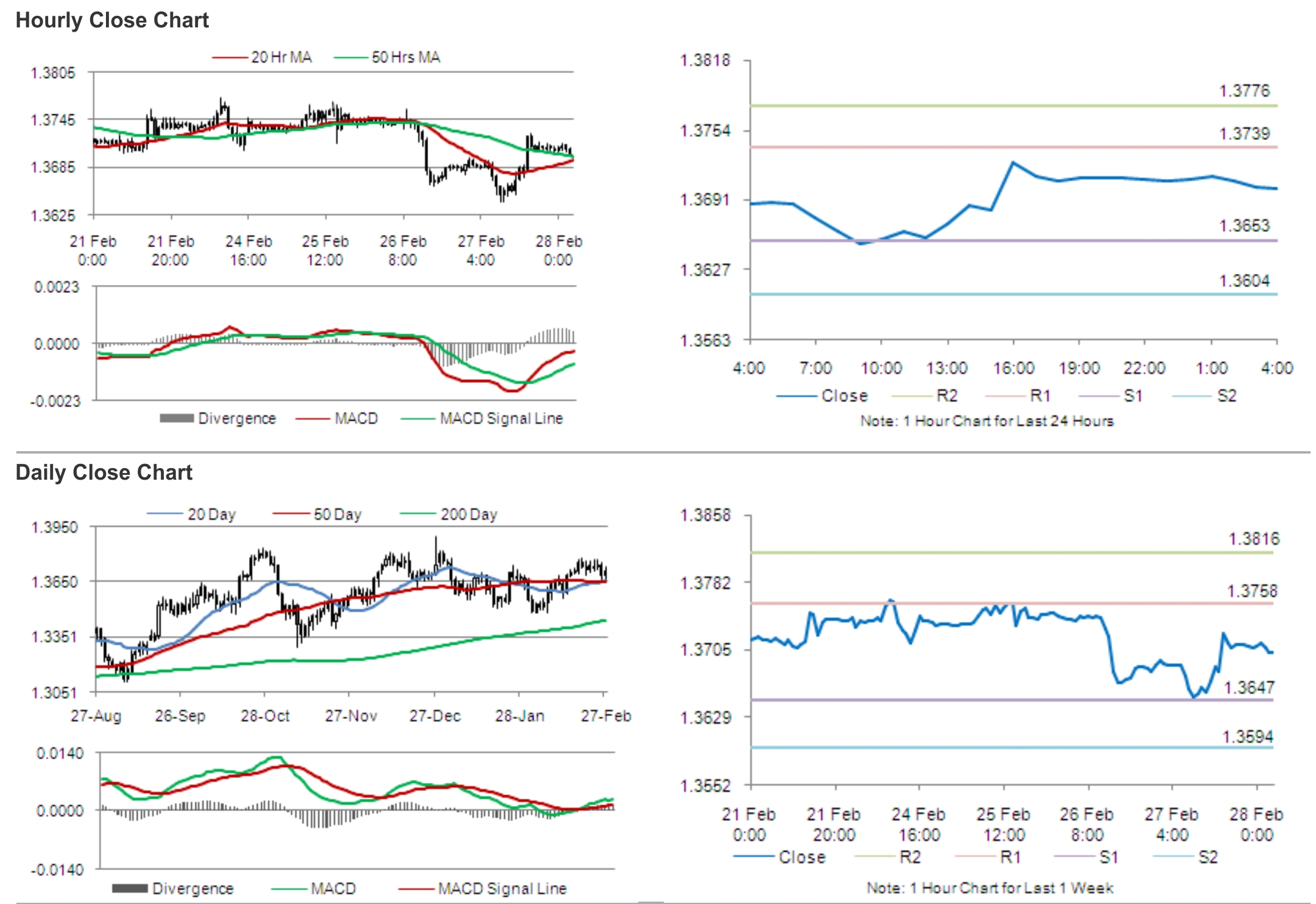

The pair is expected to find support at 1.3653, and a fall through could take it to the next support level of 1.3604. The pair is expected to find its first resistance at 1.3739, and a rise through could take it to the next resistance level of 1.3776.

Market participants keenly await Euro-zone’s consumer inflation and unemployment data for further cues in the Euro. Traders would also eye the release of the German retail sales data, due later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.