For the 24 hours to 23:00 GMT, the EUR declined 1.03% against the USD and closed at 1.2259, following downbeat industrial output data from Germany and reports that leader of Social Democrats (SPD), Martin Schulz, would not be taking over as Germany’s Finance Minister.

On the economic front, Germany’s seasonally adjusted industrial production retreated 0.6% on a monthly basis in December, less than market expectations for a fall of 0.7%. In the prior month, industrial production had recorded a revised rise of 3.1%.

Separately, the European Commission, in its winter economic forecast report, stated that the Euro-zone’s economy is expected to continue its robust growth this year and next, on the back of strong economic fundamentals and better-than-expected pick-up in global economic activity and trade. The commission projected that the common currency region would expand by 2.3% in 2018, revised up from 2.1% estimated earlier in November. Growth in 2019 is expected to be 2.0%, up from 1.9%. However, the Commission warned that uncertainties linked to Brexit and geopolitical tensions continue to pose threats to the region’s economic performance in the medium term.

The greenback gained ground against its major peers, after the US lawmakers clinched a two-year budget deal, thus pushing back concerns over a government shutdown.

On the data front, MBA mortgage applications in the US rebounded 0.7% in the week ended 02 February 2018, after recording a drop of 2.6% in the prior week. Moreover, the nation’s consumer credit climbed less-than-anticipated by $18.45 billion in December, compared to market expectations for an advance of $20.00 billion. Consumer credit had risen by a revised $31.02 billion in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.2276, with the EUR trading 0.14% higher against the USD from yesterday’s close.

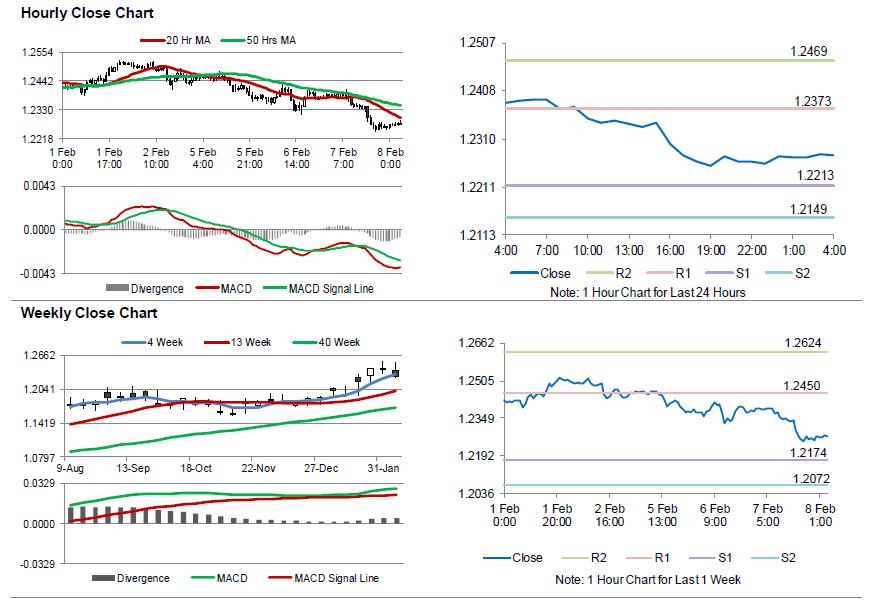

The pair is expected to find support at 1.2213, and a fall through could take it to the next support level of 1.2149. The pair is expected to find its first resistance at 1.2373, and a rise through could take it to the next resistance level of 1.2469.

Going ahead, traders would keep a close watch the Euro-zone’s economic bulletin report and Germany’s trade balance figures for December, both due to release in a few hours. Moreover, the US initial jobless claims data, due to release later today, will be on investors’ radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.