For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.3523, after data released indicated that the inflation in the Euro-zone continued to remain way below the ECB’s 2% target. The final consumer price index in the Euro-zone increased 0.5% in June on a yearly basis, in line with the preliminary estimate and compared to a similar rise recorded in the previous month. Meanwhile, the seasonally adjusted construction output in the region also reported a 1.5% decline in May, on a monthly basis, compared to a revised rise of 0.4% in the previous month. However, car sales in the Euro-bloc rose for the 10th straight month in June, registering the longest run of gain in four years.

The Euro also came under pressure, after risk appetite among investors waned following news that a Malaysia Airlines plane crashed in eastern Ukraine.

The US Dollar lost ground following downbeat housing data from the US, thereby suggesting that the housing market is still struggling to get back on track. The housing starts in the US surprisingly shrank 9.3% to a seasonally adjusted annual rate of 893.0K units in June, compared to a revised 7.3% fall in the previous month. Moreover, building permits too unexpectedly dropped by 4.2%, on monthly basis, to a seasonally adjusted annual rate of 963.0K in June, in the US, compared to a market expectations for a rise of 3.1% and from revised fall of 5.1% in the previous month. However, the number of Americans filing new claims for unemployment benefits unexpectedly dropped 3,000 to a seasonally adjusted 302,000 for the week ended July 12. Additionally, manufacturing in the Philadelphia region soared to an unexpected rise to a level of 23.9 in July, its fastest pace in more than three years, compared to a level of 17.8 in the prior month.

Yesterday, the St. Louis Fed President, James Bullard opined that with the economy attaining normalcy, the central bank may act sooner than expected to avoid any economic problems that could arise in the near future.

In the Asian session, at GMT0300, the pair is trading at 1.3526, with the EUR trading 0.02% higher from yesterday’s close.

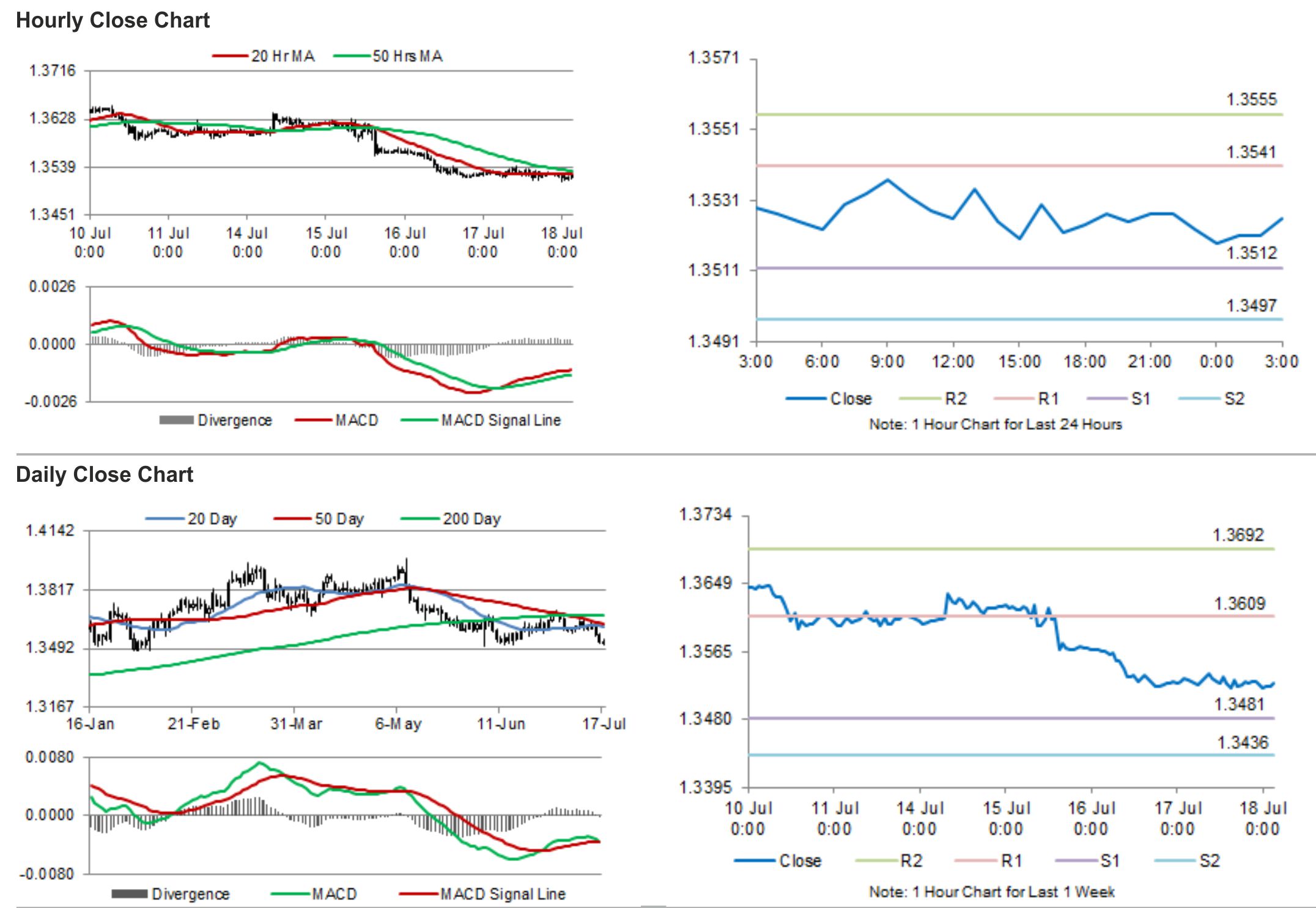

The pair is expected to find support at 1.3512, and a fall through could take it to the next support level of 1.3497. The pair is expected to find its first resistance at 1.3541, and a rise through could take it to the next resistance level of 1.3555.

Ahead in the day, investors would keep a close tab on consumer sentiment and leading indicators from the US.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.