On Friday, the EUR rose 0.07% against the USD and closed at 1.3751 after Euro zone consumer confidence registered its strongest monthly jump in nearly five years in March while the economic sentiment indicator surpassed analysts’ expectations and rose by 1.2 points in March, moving up from a reading of 101.2 to 102.4.

The US Dollar lost its appeal after the Reuters/University of Michigan reported that its index on US consumer sentiment slipped more-than-expected to a four-month low reading of 80.0 in March, from previous month’s level of 81.6. However, losses in the greenback were kept in check after US personal income gained more-than-expected 0.3% last month and personal spending came in line with market expectations for February. Meanwhile, in a speech to the Central Exchange, the Kansas City Fed President, Esther George, played down speculations surrounding the timing of an interest rate hike in the economy. She further added that the economy was witnessing signs of higher inflation which would gradually nudge the prices towards the central bank’s 2% target.

Meanwhile, consumer price index in Germany, the largest economy in the Euro-zone, missed forecasts and rose 1.0% (YoY) in March, following a 1.2% (YoY) rise in the previous month. In response to the lacklustre Germany’s consumer inflation rate, during the weekend, an ECB policymaker and Bundesbank President, Jens Weidmann urged the markets to avoid over reacting to a slowdown in the inflation rate, which according to him was caused largely by temporary cyclical factors and would exist for a short period of time. Furthermore, he opined that Euro-zone is not in a deflationary cycle but also warned about the risk to the region’s financial stability due to a prolonged period of low interest rate.

In the Asian session, at GMT0300, the pair is trading at 1.3749, with the EUR trading tad lower from Friday’s close.

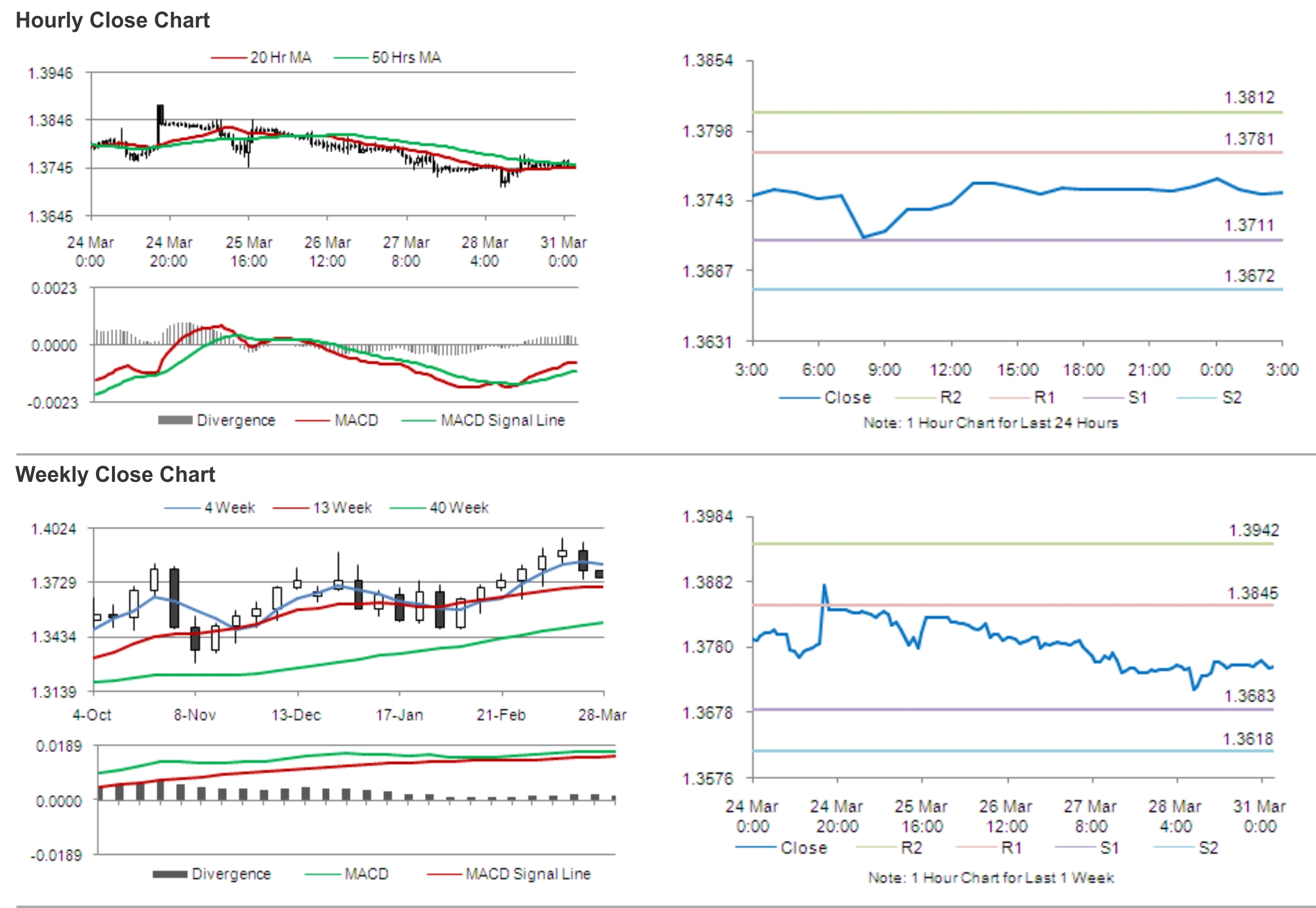

The pair is expected to find support at 1.3711, and a fall through could take it to the next support level of 1.3672. The pair is expected to find its first resistance at 1.3781, and a rise through could take it to the next resistance level of 1.3812.

Traders keenly await the Euro-zone’s consumer inflation data, slated for release later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.