For the 24 hours to 23:00 GMT, the EUR declined 0.26% against the USD and closed at 1.1136, on dovish comments from the European Central Bank (ECB) Chief, Mario Draghi.

The ECB President, in his testimony to the European Parliament, reaffirmed his view that the Euro-zone’s economy still needs support of the central bank’s expansive monetary stimulus to durably stabilise inflation around 2.0%, even though the common currency region is showing strong resurgence in the economic growth. Further, Draghi added that the ECB will be in a better position at its June meeting to reassess the outlook for growth and inflation.

On Friday, data indicated that Italy’s consumer confidence index dropped more-than-anticipated to a level of 105.4 in May, compared to a revised reading of 107.4 in the prior month, while markets were expecting the index to ease to a level of 107.3.

On Friday, the second estimate of US annualised gross domestic product (GDP) was revised up sharply to 1.2% on a quarterly basis in the first quarter of 2017, compared to an advance of 0.7% registered in the preliminary print, suggesting that weakness in the nation’s economic performance is likely to be transitory. However, it was the weakest performance since the first quarter of 2016. The GDP had risen 2.1% in the previous quarter, while investors had envisaged the nation to expand 0.9%.

In other economic news, flash durable goods orders in the US eased less-than-expected by 0.7% on a monthly basis in April, dropping for the first time in five months and compared to market expectations for a fall of 1.5%. In the prior month, durable goods orders had gained by a revised 2.3%. Meanwhile, the nation’s final Reuters/Michigan consumer sentiment index rose less-than-expected to a level of 97.1 in May, compared to a reading of 97.0 in the previous month, while the preliminary print had indicated an increase to a level of 97.7.

Separately, on Friday, the Federal Reserve (Fed) Bank of San Francisco President, John Williams, reiterated his view that the Fed is likely to raise interest rates a total of three times this year.

In the Asian session, at GMT0300, the pair is trading at 1.1128, with the EUR trading 0.07% lower against the USD from yesterday’s close.

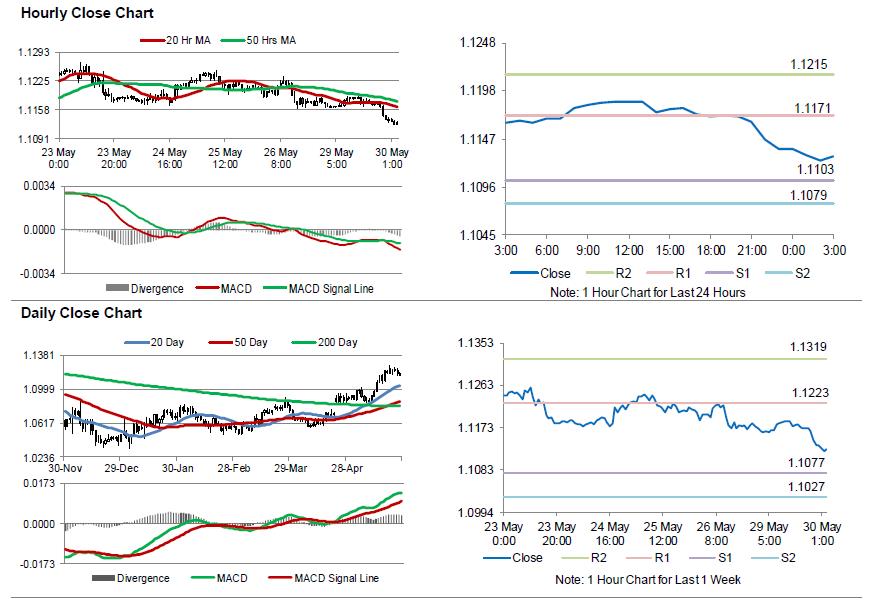

The pair is expected to find support at 1.1103, and a fall through could take it to the next support level of 1.1079. The pair is expected to find its first resistance at 1.1171, and a rise through could take it to the next resistance level of 1.1215.

Moving ahead, investors will look forward to Germany’s flash inflation figures and the Euro-zone’s final consumer confidence data, both for May, slated to release in a few hours. Moreover, in the US, consumer confidence, personal income and personal spending data, all for May, set to be released later today, will be on investors’ radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.