For the 24 hours to 23:00 GMT, the EUR declined 0.14% against the USD and closed at 1.0722, after the Euro-zone’s consumer confidence index fell unexpectedly to a level of -4.60 in April, compared to market expectations of an advance to a level of -2.50.

In the previous month, the consumer confidence index had recorded a reading of -3.70.

The greenback traded higher, on the back of upbeat existing home sales in the US.

Data showed that existing home sales in the US registered a rise of 6.10% on a monthly basis notching a 18-month high level in March, beating market expectations for a 3.1% rise. It registered a revised increase of 1.5% in the preceding month. Meanwhile, mortgage applications climbed 2.30% in the US on a weekly basis, in the week ended 17 April 2015. In the previous week, mortgage applications had dropped 2.30%.

In the Asian session, at GMT0300, the pair is trading at 1.0696, with the EUR trading 0.25% lower from yesterday’s close.

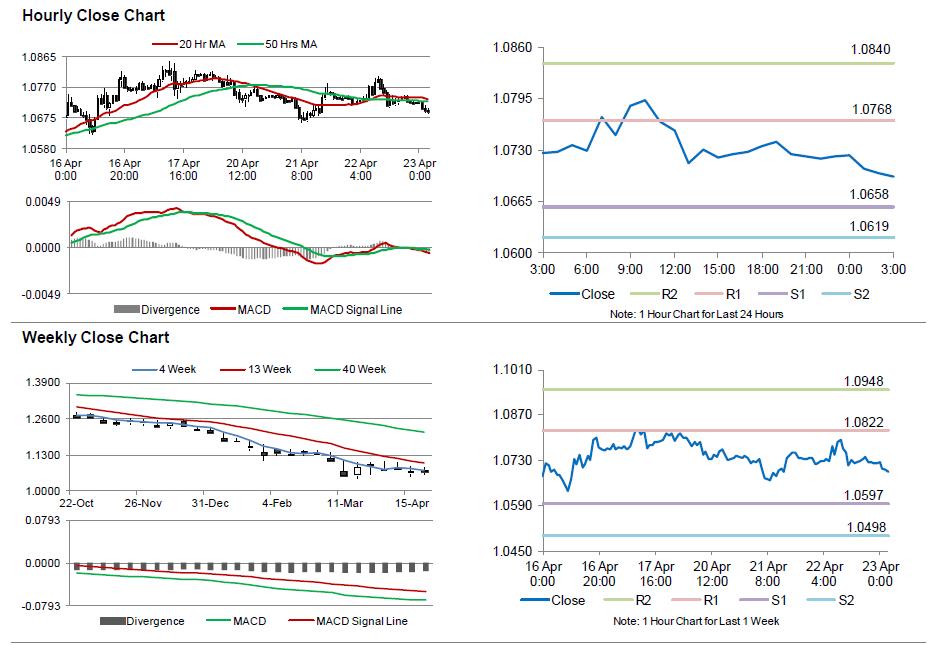

The pair is expected to find support at 1.0658, and a fall through could take it to the next support level of 1.0619. The pair is expected to find its first resistance at 1.0768, and a rise through could take it to the next resistance level of 1.0840.

Trading trends in the pair today are expected to be determined by the Euro-zone’s manufacturing PMI along with its peripheries, scheduled in a few hours for further direction.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.