For the 24 hours to 23:00 GMT, EUR rose 0.12% against the USD and closed at 1.3925, rebounding from its earlier losses, resulting from a lacklustre Euro-zone’s consumer inflation report, which showed that consumer inflation rate in the region fell to 0.7% (YoY) in February, contradicting analysts’ call for the inflation rate to come in unchanged at previous month’s level of 0.8%.

Separately, the European Central Bank (ECB) Governing Council member and the Bundesbank President, Jens Weidmann indicated that the German economy would continue to witness a surplus in its trade balance even if it reforms its economy.

Meanwhile, the US Dollar came under pressure following news that an earthquake of 4.4 magnitude hit the Los Angeles city of California in the US. Moreover, downbeat factory activity data in the New York state softened demand for the greenback despite a better-than-expected national industrial output figure. Data showed that industrial production in the US rose more-than-expected 0.6% (MoM) in February, the largest gain in 6 months and compared to a 0.2% drop registered in the previous month. However, the NY Empire State manufacturing index rose to a figure of 5.61 in March, less than market estimate and compared to previous month’s reading of 4.48. Likewise, the US NAHB housing market index rose less-than-expected to a reading of 47.0 in March, the second-lowest reading since May 2013, from a level of 46.0 registered in the previous month.

Additionally, investors preferred to remain on sidelines after the US President Barack Obama imposed sanctions on 7 top Russian government officials after the vote in the Crimean peninsula.

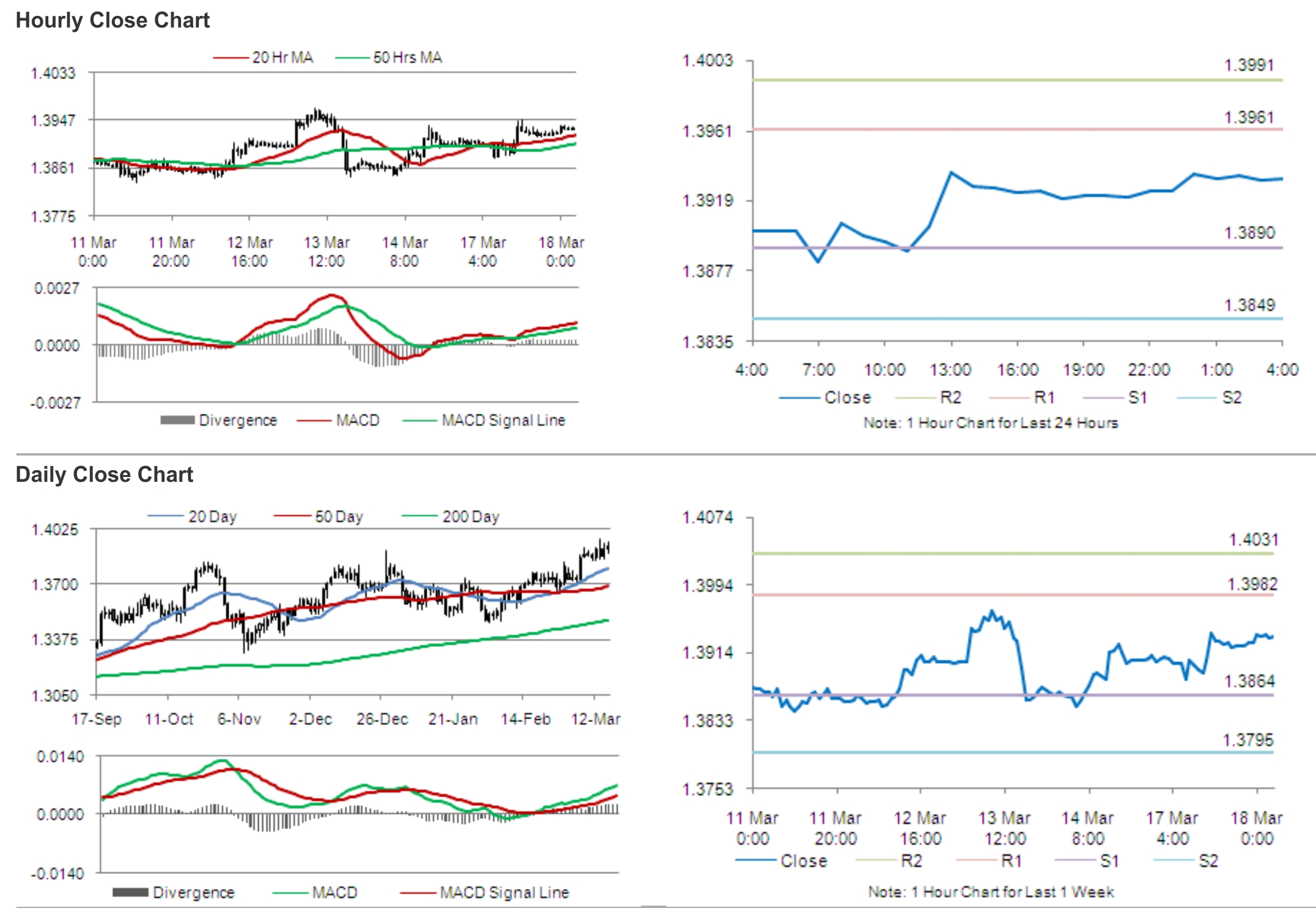

In the Asian session, at GMT0400, the pair is trading at 1.3932, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.3890, and a fall through could take it to the next support level of 1.3849. The pair is expected to find its first resistance at 1.3961, and a rise through could take it to the next resistance level of 1.3991.

Traders keenly await Euro-zone’s trade balance data and ZEW’s report on the Euro-zone’s and Germany’s economic sentiment, slated for release later today. Meanwhile, in addition to the US building permits and housing starts data, the consumer inflation numbers would also be gauged by investors.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.