For the 24 hours to 23:00 GMT, the EUR declined 0.13% against the USD and closed at 1.0715.

On the economic front, the Euro-zone’s final consumer price index (CPI) climbed 1.5% on an annual basis in March, in line with market expectations and confirming the preliminary print. In the previous month, the CPI had recorded a rise of 2.0%. Moreover, the region’s seasonally adjusted trade surplus widened more-than-anticipated to a level of €19.2 billion in February, from a trade surplus of €15.7 billion in the previous month, while markets expected the region to post a trade surplus of €18.0 billion.

In the US, the Federal Reserve (Fed) Beige Book revealed that the US economy expanded at a modest-to-moderate pace during mid-February to the end of March as a tighter labour market helped broaden wage gains, but inflation pressures remained modest. Moreover, a large number of firms reported high turnover rates and challenges in retaining staff.

On the data front, the US MBA mortgage applications dropped 1.8% in the week ended 14 April 2017, following a rise of 1.5% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.0714, with the EUR trading slightly lower against the USD from yesterday’s close.

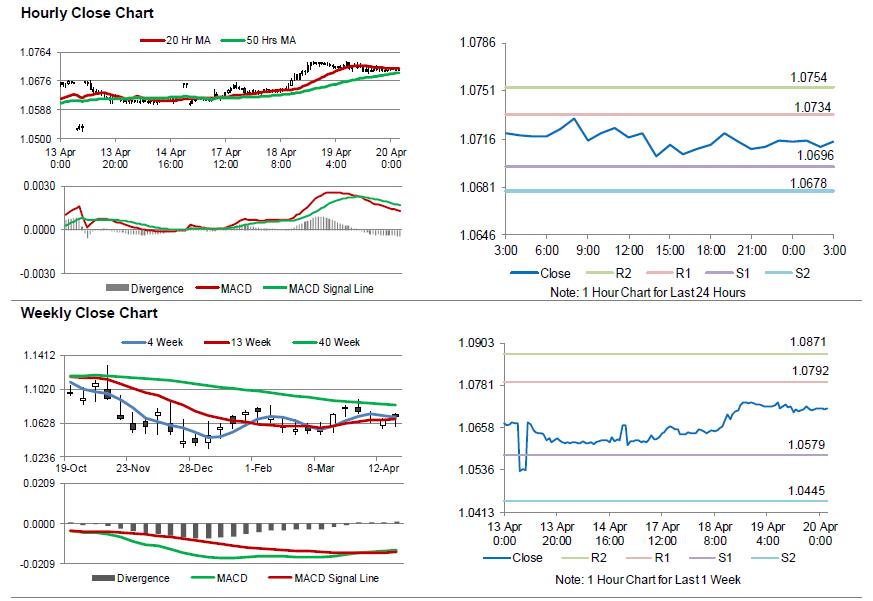

The pair is expected to find support at 1.0696, and a fall through could take it to the next support level of 1.0678. The pair is expected to find its first resistance at 1.0734, and a rise through could take it to the next resistance level of 1.0754.

Moving ahead, market participants await the release of the flash consumer confidence index for April and construction output data for February from the Euro-zone, both slated to release in a few hours. Moreover, the US leading indicators for March, Philadelphia Fed business outlook index for April and weekly jobless claims data, all slated to release later in the day, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.