For the 24 hours to 23:00 GMT, the EUR declined 0.41% against the USD and closed at 1.0506.

Macroeconomic data indicated that the Euro-zone’s flash consumer price index (CPI) surged to a 4-year high level in February, after it jumped 2.0% on an annual basis, meeting market expectations and zooming past the European Central Bank’s (ECB) target of just under 2.0%, thus indicating that the central bank is likely to face renewed pressure to taper its ultra-loose monetary policy. In the previous month, the CPI had recorded a gain of 1.8%. Moreover, the region’s unemployment rate remained steady at a more than 7-year low level of 9.6% in January, in line with market consensus.

The greenback gained ground against a basket of major currencies, fuelled by robust weekly jobs data that stepped up bets for a March interest rate hike.

Data showed that the number of Americans filing for fresh jobless claims unexpectedly dropped to a level of 223.0K in the week ended 25 February 2017, confounding market expectations of a rise to a level of 245.0 K, declining to a nearly 44-year low level, pointing to further strength in the nation’s labour market. In the prior week, initial jobless claims had registered a revised level of 242.0K.

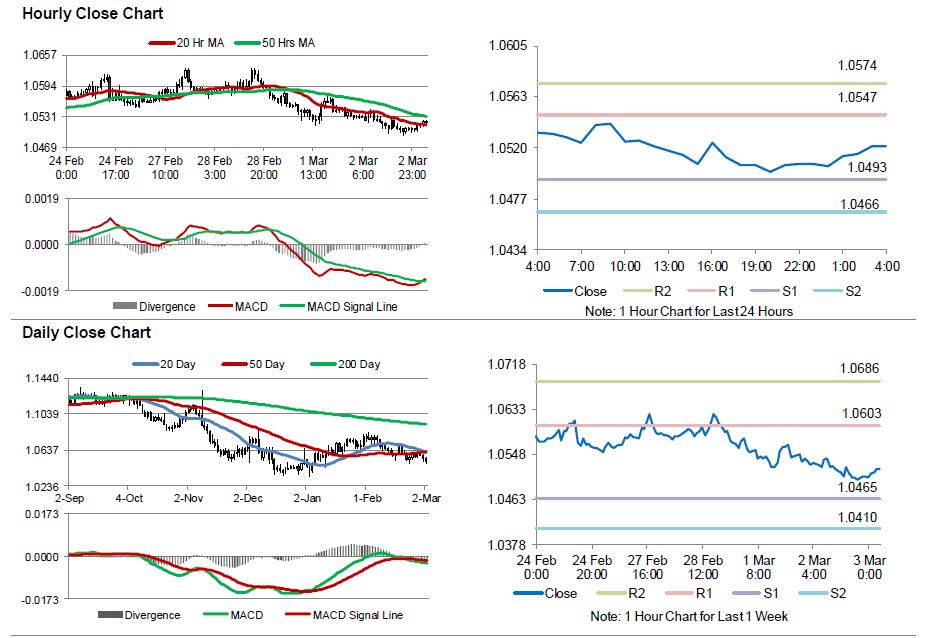

In the Asian session, at GMT0400, the pair is trading at 1.0521, with the EUR trading 0.14% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0493, and a fall through could take it to the next support level of 1.0466. The pair is expected to find its first resistance at 1.0547, and a rise through could take it to the next resistance level of 1.0574.

Going ahead, traders would focus on the final Markit services PMI for February and retail sales data for January across the Euro-zone, scheduled to release in a few hours. Additionally, all eyes would be on the comments from the Federal Reserve Chair, Janet Yellen, as well as Vice Chair, Stanley Fischer, scheduled to speak later today. Also, the US ISM non-manufacturing PMI and the final Markit services PMI, both for February, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.