For the 24 hours to 23:00 GMT, the EUR rose 0.09% against the USD and closed at 1.1231 on Friday, after the Euro-zone’s preliminary consumer price index (CPI) rose by 0.4% on an annual basis in September, in line with market expectations, notching its highest level in almost two years, thus offering some hopes that the ECB’s stimulus programme might eventually fuel economic growth in the Euro-bloc. The CPI had recorded a gain of 0.2% in the preceding month. Meanwhile, the region’s unemployment rate surprisingly remained steady at a five-year low level of 10.1% in August, sticking to its 5-year low level for a fourth straight month, while markets anticipated it to fall to 10.0%.

Elsewhere, in Germany, retail sales fell more-than-expected by 0.4% MoM in August, against market expectations for a drop of 0.2% and following a revised gain of 0.5% in the previous month.

On Friday, the Dallas Fed President, Robert Kaplan, suggested that the Federal Reserve can continue to be patient in raising interest rates, citing no evidence of economy overheating in the US.

Macroeconomic data released in the US indicated that, the final Reuters/Michigan consumer confidence index advanced more-than-anticipated to a level of 91.2 in September, climbing for the first time in four months as Americans grew more optimistic about the nation’s growth prospects. Markets anticipated the index to increase to a level of 90.0, after recording a reading of 89.8 in the preliminary print. Additionally, the nation’s personal income edged up by 0.2% in August, at par with market expectations and following a gain of 0.4% in the previous month. On the contrary, the nation’s personal spending unexpectedly remained flat in August, defying investor consensus for a gain of 0.1% and compared to a revised reading of 0.4% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1230, with the EUR trading marginally lower against the USD from Friday’s close.

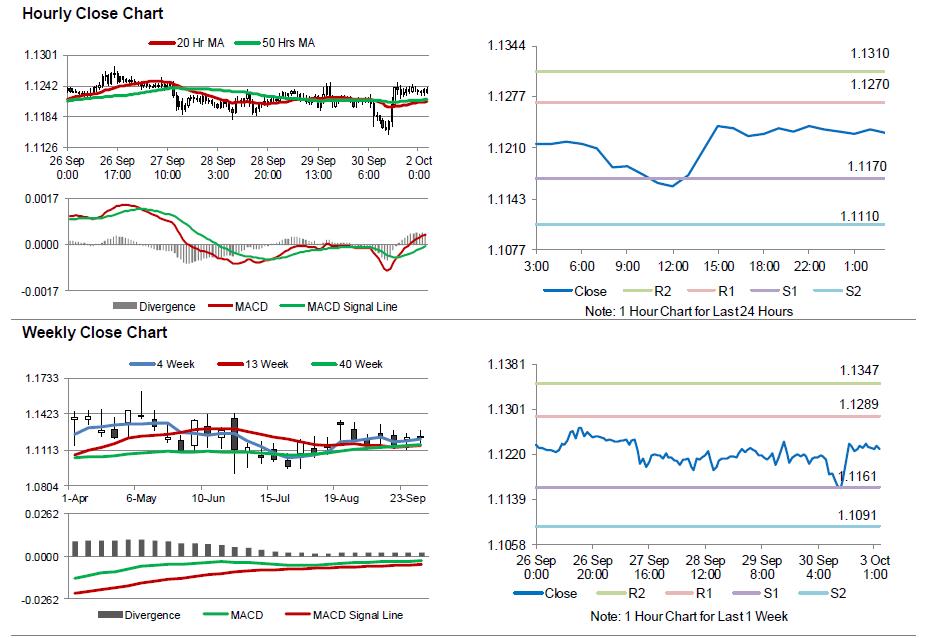

The pair is expected to find support at 1.1170, and a fall through could take it to the next support level of 1.1110. The pair is expected to find its first resistance at 1.1270, and a rise through could take it to the next resistance level of 1.1310.

Moving ahead, investors would look forward to the final Markit manufacturing PMI for September across the Euro-zone, slated to release in a few hours. Additionally, the US ISM manufacturing PMI and the final Markit manufacturing PMI, both for September as well as construction spending for August, all due to release later in the day, would garner a lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.