For the 24 hours to 23:00 GMT, the EUR declined 0.2% against the USD and closed at 1.2047 on Friday, after data indicated that annual inflation in the Euro-zone slowed in December.

The Euro-zone’s preliminary consumer price index (CPI) climbed 1.4% on an annual basis in December, meeting market expectations and after recording a rise of 1.5% in the prior month, thus indicating that strong economic conditions in the common currency region have not translated into higher inflation.

Separately, Germany’s retail sales rebounded more-than-expected by 2.3% on a monthly basis in November, surging by the most in a year and hinting that an upturn in the nation’s private consumption is on the cards. Retail sales had recorded a drop of 1.2% in the previous month, while markets had anticipated for a gain of 1.0%. Additionally, activity in the nation’s construction sector expanded at its quickest pace in four months, after it advanced to a level of 53.7 in December, driven by robust growth in commercial building work. The PMI had recorded a reading of 53.1 in the preceding month.

The greenback advanced against a basket of major currencies, as investors shrugged off downbeat US non-farm payrolls report and cherished robust wage growth data.

Non-farm payrolls in the US increased less-than-anticipated by 148.0K in December, against market anticipations for an advance of 190.0K. Non-farm payrolls had recorded a revised increase of 252.0K in the previous month. On the other hand, the nation’s average hourly earnings of all employees gained 0.3% on a monthly basis in December, meeting market expectations, thus offering initial signs of a pick-up in wage growth. Average hourly earnings of all employees posted a revised increase of 0.1% in the prior month. Moreover, the nation’s unemployment rate remained steady at 4.1% in December, in line with market expectations.

Another set of data revealed that the ISM non-manufacturing PMI in the US unexpectedly eased to a level of 55.9 in December, defying market expectations for a rise to a level of 57.6 and compared to a reading of 57.4 in the prior month. Further, the nation’s trade deficit widened to a nearly six-year high level of $50.5 billion in November, as imports of goods jumped to a record high amid strong domestic demand. The nation had posted a revised trade deficit of $48.9 billion in the prior month, while market participants had envisaged for a deficit of $49.9 billion.

Nevertheless, the nation’s factory orders climbed 1.3% on a monthly basis in November, surpassing market expectations for an advance of 1.1%. Factory orders had registered a revised rise of 0.4% in the previous month. Also, the nation’s final durable goods orders gained 1.3% in November, confirming the preliminary print and following a revised decline of 0.4% in the prior month.

Meanwhile, the Philadelphia Federal Reserve (Fed) President, Patrick Harker pencilled-in only two interest rate increases in 2018, while the San Francisco Fed President, John Williams shared his expectation of three interest rates hikes this year, citing an already strong economy. Further, the Cleveland Fed President, Loretta Mester, stated that she expects roughly four interest rate hikes this year.

In the Asian session, at GMT0400, the pair is trading at 1.2033, with the EUR trading 0.12% lower against the USD from Friday’s close.

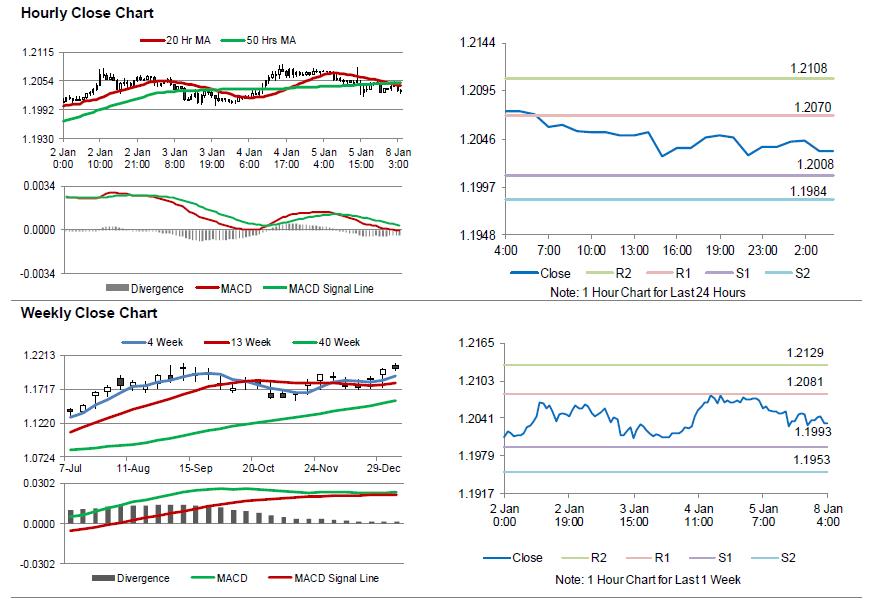

The pair is expected to find support at 1.2008, and a fall through could take it to the next support level of 1.1984. The pair is expected to find its first resistance at 1.2070, and a rise through could take it to the next resistance level of 1.2108.

Moving ahead, investors would focus on the Euro-zone’s retail sales figures for November, the Sentix investor confidence index for January as well as Germany’s factory orders data for November, all due to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.