For the 24 hours to 23:00 GMT, the EUR rose 0.11% against the USD and closed at 1.1384, after Italy and the European Commission reached a new budget deal.

Macroeconomic data indicated that the Euro-zone’s seasonally adjusted construction output retreated 1.6% on a monthly basis in October. In the prior month, construction output had recorded a revised rise of 2.1%.

Separately, in Germany, the producer price index (PPI) rose to a 19-month high level of 3.3% on an annual basis in November, higher than market expectations for a rise of 3.1%. The PPI had registered a similar rise in the prior month.

The US dollar declined against Euro, following the US Federal Reserve’s (Fed) rate hike decision.

The Fed, in its December monetary policy meeting, raised its benchmark interest rate by 25 basis points to a range of 2.25% to 2.50%, marking its fourth hike this year and amid robust labour market and strong growth momentum. However, the central bank lowered its 2019 interest rate projection to two hikes, compared to three rate increases previously forecasted. The central bank also lowered its forecasts for real GDP growth in 2018 and 2019 to 3.0% and 2.3%, respectively.

In the US, data showed that the US existing home sales unexpectedly climbed by 1.9% on monthly basis, to a level of 5.32 million in November, defying market expectations for a level of 5.20 million. In the preceding month, existing home sales had recorded a reading of 5.22 million. On the other hand, the nation’s mortgage applications declined 5.8% on a weekly basis in the week ended 14 December 2018, following a gain of 1.6% in the previous week.

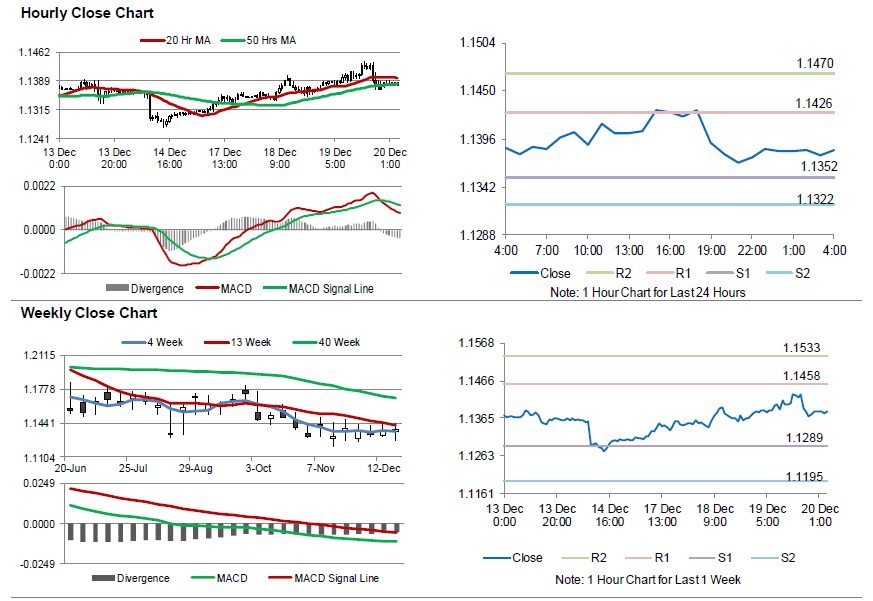

In the Asian session, at GMT0400, the pair is trading at 1.1383, with the EUR trading a tad lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1352, and a fall through could take it to the next support level of 1.1322. The pair is expected to find its first resistance at 1.1426, and a rise through could take it to the next resistance level of 1.1470.

Going forward, traders would await the Euro-zone’s current account balance for October, set to release in a few hours. Later in the day, the US Philadelphia Fed business outlook for December and the leading index for November followed by initial jobless claims, will be on investors radar.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.