For the 24 hours to 23:00 GMT, the EUR traded flat against the USD and closed at 1.0977.

On the data front, Euro-zone’s seasonally adjusted construction output slid 0.9% on a monthly basis in August, dropping for the first time in five months, following a revised gain of 1.5% in the prior month.

According to the US Fed’s latest Beige Book, most districts in the US indicated a modest or moderate pace of expansion, from late August to early October, amid tight labour markets and steady wage gains. Further, it indicated that outlook was mostly positive, with growth expected to continue at a slight to moderate pace in several districts. It also stated that economic uncertainty surrounding the upcoming presidential election is weighing on some business sectors in the country.

In other economic news, the US building permits rose by 6.3% on a monthly basis to an annual rate of 1225.0K in September, surpassing market expectations for a rise to a level of 1165.0K and after recording a revised level of 1152.0K in the prior month. Additionally, the nation’s mortgage applications rose by 0.6% in the week ended 14 October 2016, following a drop of 6.0% in the previous week. On the contrary, the nation’s housing starts unexpectedly dropped by 9.0% on a monthly basis to an annual rate of 1047.0K in September, dropping for the second straight month and defying market expectations for an advance to a level of 1175.0K. Housing starts recorded a revised reading of 1150.0K in the prior month.

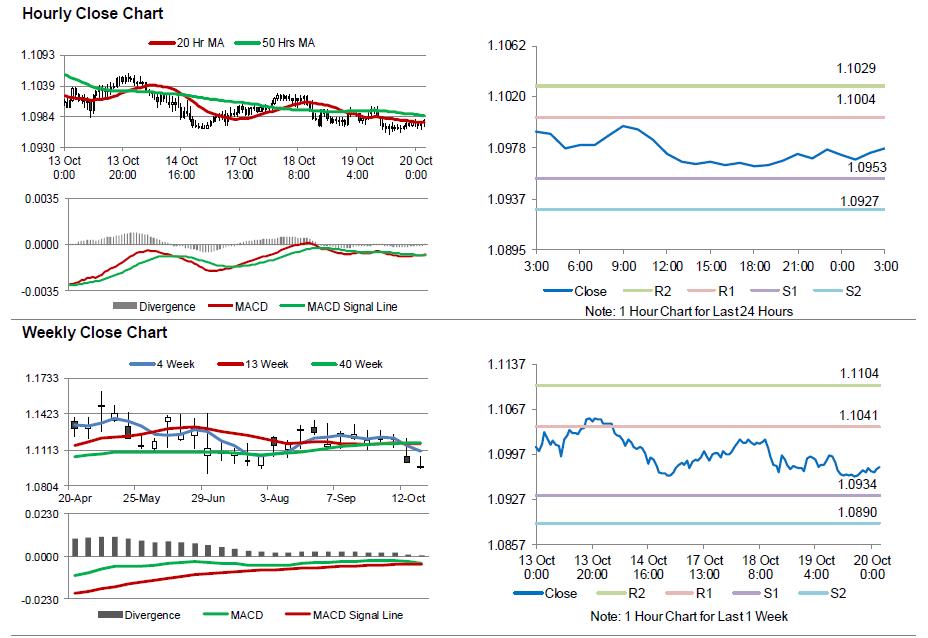

In the Asian session, at GMT0300, the pair is trading at 1.0978, with the EUR trading a tad higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0953, and a fall through could take it to the next support level of 1.0927. The pair is expected to find its first resistance at 1.1004, and a rise through could take it to the next resistance level of 1.1029.

Moving ahead, investors would keenly await European Central Bank’s interest rate decision, due in a few hours, which is widely expected to remain steady at 0.00%. Additionally, in the US, existing home sales and CB leading indicator data, both for September, Philadelphia Fed manufacturing survey for October along with initial jobless claims, all due to release later in the day, would pique a lot of investor attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.