For the 24 hours to 23:00 GMT, the EUR rose 0.19% against the USD and closed at 1.0662.

In economic news, Euro-zone’s construction output declined 0.4% MoM in September, after recording a revised 0.5% rise in the previous month, thus indicating that the Euro-zone economy is still struggling to recover.

In the US, minutes of the October monetary policy meeting indicated that majority of the officials at the FOMC rooted for an interest rate hike in December and further stated that the interest rate hike would be dependent on the incoming macroeconomic data.

In other economic news, US housing starts declined 11.0% MoM in October to an annual level of 1060.0K, its lowest level since March 2015, compared to market expectations of 1160.0K, and after recording a revised reading of 1191.0K in the previous month. On the other hand, the nation’s building permits rose 4.1% MoM to an annual rate of 1150.0K in October, compared to a revised reading of 1105.0K in the previous month. Markets were expecting it to rise to 1147.0K. Additionally, US MBA mortgage applications rose 6.2% in the week ended 13 November, after registering a drop of 1.3% in the previous week.

Separately, the Dallas Fed president, Rob Kaplan and Atlanta Fed President, Dennis Lockhart, indicated that it was time to end the zero interest rate policy.

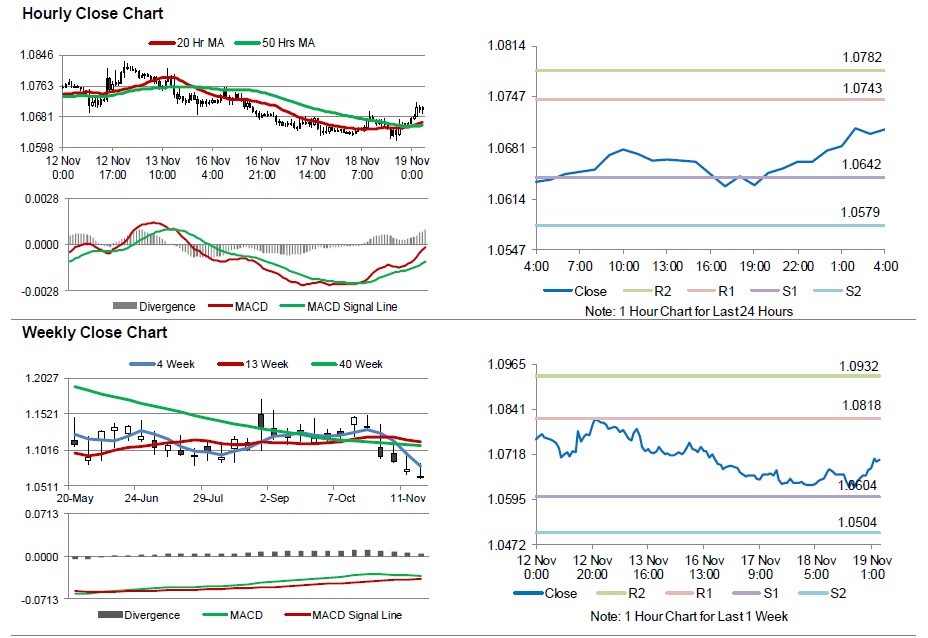

In the Asian session, at GMT0400, the pair is trading at 1.0705, with the EUR trading 0.4% higher from yesterday’s close.

The pair is expected to find support at 1.0642, and a fall through could take it to the next support level of 1.0579. The pair is expected to find its first resistance at 1.0743, and a rise through could take it to the next resistance level of 1.0782.

Going ahead, market participants will look forward to the ECB monetary policy meeting accounts, scheduled to be released later in the day. Additionally, investors will also concentrate on the US initial jobless claims, CB leading indicator and the Philadelphia Fed manufacturing survey data, due later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.