For the 24 hours to 23:00 GMT, the EUR declined 0.1% against the USD and closed at 1.0625.

In economic news, Euro-zone’s flash consumer confidence index improved more-than-expected to a level of -6.1 in November, notching its highest level since December 2015. The index had recorded a reading of -8.0 in the previous month while markets expected it to advance to a level of -7.8.

The US Dollar gained ground against most of its major peers, after robust US existing home sales data cemented expectations for a Federal Reserve interest rate hike in December.

Data indicated that existing home sales unexpectedly surged to its highest level since February 2007, after it increased by 2.0% on a monthly basis, to a level of 5.6 million in October, defying markets consensus for a fall to a level of 5.4 million and compared to a revised reading of 5.5 million in the prior month. Also, the nation’s Richmond Fed manufacturing index climbed to a level of 4.0 in November, strengthening to its highest level in four months and confounding market expectations for the index to record a flat reading. In the prior month, the index had recorded a level of -4.0.

In the Asian session, at GMT0400, the pair is trading at 1.0624, with the EUR trading marginally lower against the USD from yesterday’s close.

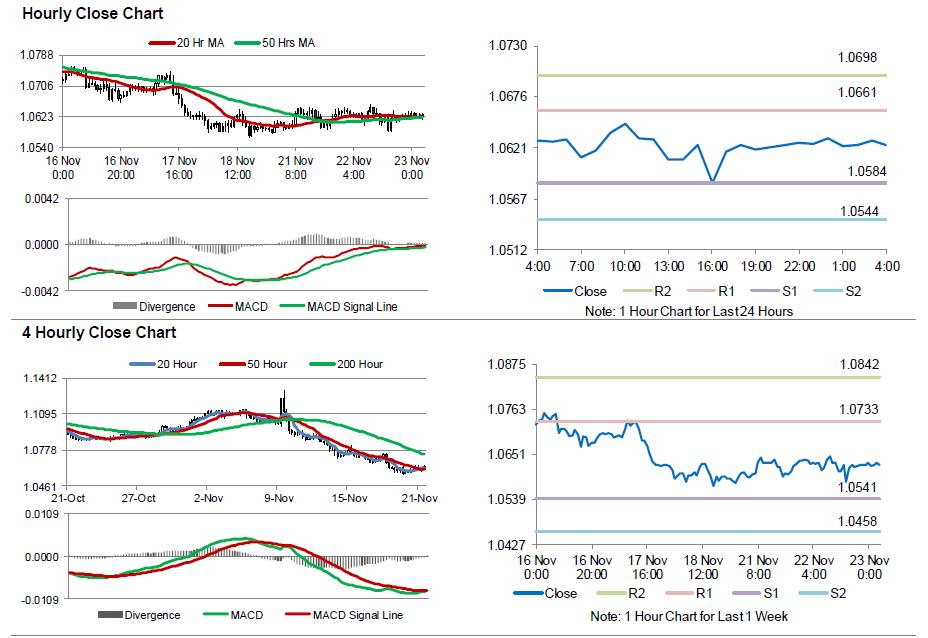

The pair is expected to find support at 1.0584, and a fall through could take it to the next support level of 1.0544. The pair is expected to find its first resistance at 1.0661, and a rise through could take it to the next resistance level of 1.0698.

Moving ahead, investors would turn their attention to the Markit manufacturing and services PMIs across the Euro-zone, due to release in a few hours. Additionally, in the US, minutes from the most recent FOMC meeting are set to be released later in the day. Moreover, a slew of economic data from the US, consisting of flash durable goods orders and new home sales, both for October, preliminary Markit manufacturing PMI and Michigan consumer confidence index, both for November accompanied with weekly jobless claims data, all scheduled to release later today, would pique a lot of investor attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.