For the 24 hours to 23:00 GMT, the EUR declined 0.44% against the USD and closed at 1.1691.

Data indicated that Euro-zone’s preliminary consumer confidence index dropped to -0.6 in July, less than market consensus for a drop to a level of -0.7 and marking its lowest level in nine months. In the previous month, the index had registered a reading of -0.5.

In the US, data showed that, US existing home sales unexpectedly fell 0.6% on monthly basis to a level of 5.38 million in June, for the third consecutive month and defying market expectations for a climb to a level of 5.44 million. In the preceding month, existing home sales recorded a revised reading of 5.41 million.

Meanwhile, the nation’s Chicago Fed national activity index rebounded to a level of 0.43 in June, compared to a revised level of -0.45 in the previous month. Markets participants had expected the index to rise to a level of 0.25.

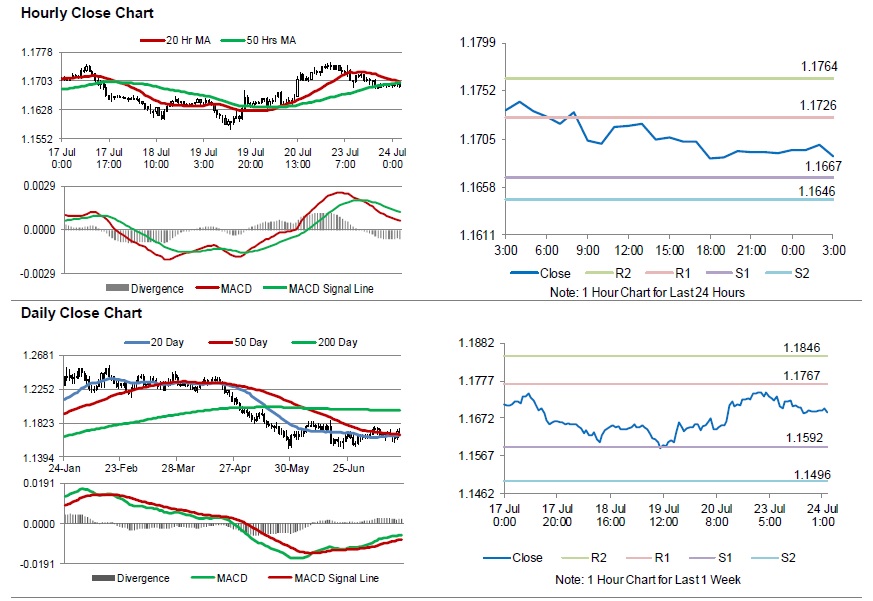

In the Asian session, at GMT0300, the pair is trading at 1.1688, with the EUR trading a tad lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1667, and a fall through could take it to the next support level of 1.1646. The pair is expected to find its first resistance at 1.1726, and a rise through could take it to the next resistance level of 1.1764.

Going forward, investors will keep an eye on the Markit manufacturing and services PMI for July, set to release across the euro bloc. Later in the day, the US house price index for May and the flash Markit manufacturing & services PMI for July, will garner significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.