For the 24 hours to 23:00 GMT, the EUR declined 0.50% against the USD and closed at 1.1539, amid dismal economic data.

On the data front, the Euro-zone’s preliminary consumer confidence index dropped to a 15-month low level of -1.9 in August, compared to market expectations for a fall to a level of -0.7. The index had recorded a level of -0.6 in the prior month. Moreover, the region’s flash manufacturing PMI unexpectedly slid to a level of 54.6 in August, marking its 21-month low level and defying market expectations for an advance to a level of 55.2. In the previous month, the PMI had registered a level of 55.1. On the contrary, the nation’s preliminary services PMI expanded to 54.4 in August, in line with market expectations and after recording a reading of 54.2 in the preceding month.

Separately, in Germany, the Markit preliminary manufacturing PMI dropped more than expectations to 56.1 in August, compared to a level of 56.9 in the prior month. On the other hand, the flash services PMI advanced to a level of 55.2 in August, following market consensus for a gain to a level of 54.3. The PMI had registered a reading of 54.1 in the previous month.

The minutes of the European Central Bank (ECB) July monetary policy meeting revealed that the economy remained strong throughout the ongoing trade disputes and growing protectionism fears. However, the officials cautioned over worries about trade war and protectionism posed biggest risks to the Euro-zone’s economy.

In the US, data showed that, the US flash Markit manufacturing PMI declined to a level of 54.5 in August, losing its momentum and hitting its lowest level since November 2017 while markets had envisaged for a drop to a level of 55.0. The PMI had registered a reading of 55.3 in the previous month. Meanwhile, the nation’s the flash Markit services PMI fell to a 4-month low level of 55.2 in August, following to a level of 56.0 in the prior month. Market participants had expected the PMI to dip to a level of 55.8. Additionally, the US new home sales unexpectedly slid 1.7% to a level of 627.0K on a monthly basis in July, reaching its lowest level in 9-months and affected by elevated costs of construction and lack of labour and land. In the prior month, new home sales had registered a revised level of 638.0K, while market participants had expected for an increase to a level of 645.0K.

Meanwhile, the US housing price index increased 0.2% on a monthly basis in June, undershooting market consensus for a rise of 0.3%. In the previous month, the index had registered a revised rise of 0.4%. Furthermore, US seasonally adjusted initial jobless claims surprisingly eased to a level of 210.0K in the week ended 18 August 2018, compared to a level of 212.0K in the prior week. Markets had envisaged initial jobless claims to climb to 215.0K.

In the Asian session, at GMT0300, the pair is trading at 1.1555, with the EUR trading 0.14% higher against the USD from yesterday’s close.

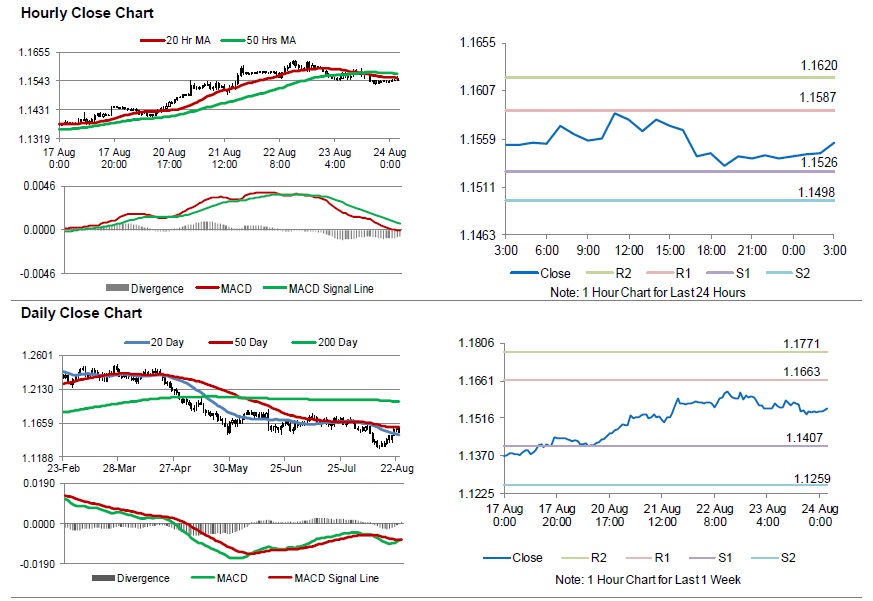

The pair is expected to find support at 1.1526, and a fall through could take it to the next support level of 1.1498. The pair is expected to find its first resistance at 1.1587, and a rise through could take it to the next resistance level of 1.1620.

Looking ahead, investors will closely monitor Germany’s final 2Q GDP data, set to release in a while. Later in the day, the US durable goods order for July, will keep traders on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.