For the 24 hours to 23:00 GMT, the EUR slightly declined against the USD and closed at 1.0713.

On the data front, the Euro-zone’s flash consumer confidence index improved more-than-expected to a level of -3.6 in April, surging to its highest level in nearly nine years, thus pointing to a continued pickup in the region’s consumer optimism, despite political uncertainties ahead of upcoming French elections. Markets expected for an advance to a level of -4.8, after recording a level of -5.0 in the previous month. Moreover, the region’s seasonally adjusted construction output climbed 6.9% on a monthly basis in February, accelerating at its fastest pace in nearly five-years. Construction output had registered a revised drop of 2.4% in the previous month.

Elsewhere, Germany’s producer prices rose 3.1% YoY in March, less than market expectations for a gain of 3.2% and following a similar rise in the prior month.

Meanwhile, the latest polls indicated that French centrist presidential candidate, Emmanuel Macron, is maintaining a slim lead over his rivals.

Macroeconomic data released in the US showed that initial jobless claims advanced more-than-anticipated to a level of 244.0K in the week ended 15 April 2017, compared to a reading of 234.0K in the previous week. Market were expecting initial jobless claims to rise to a level of 240.0K. Additionally, the nation’s Philadelphia Fed manufacturing index eased to a level of 22.0 in April, more than market expectations of a fall to a level of 25.5 and following a level of 32.8 in the prior month.

On the other hand, the US leading indicator climbed 0.4% in March, surpassing market consensus for a rise of 0.2%. In the previous month, leading indicator had registered a rise of 0.6%.

In the Asian session, at GMT0300, the pair is trading at 1.0714, with the EUR trading slightly higher against the USD from yesterday’s close.

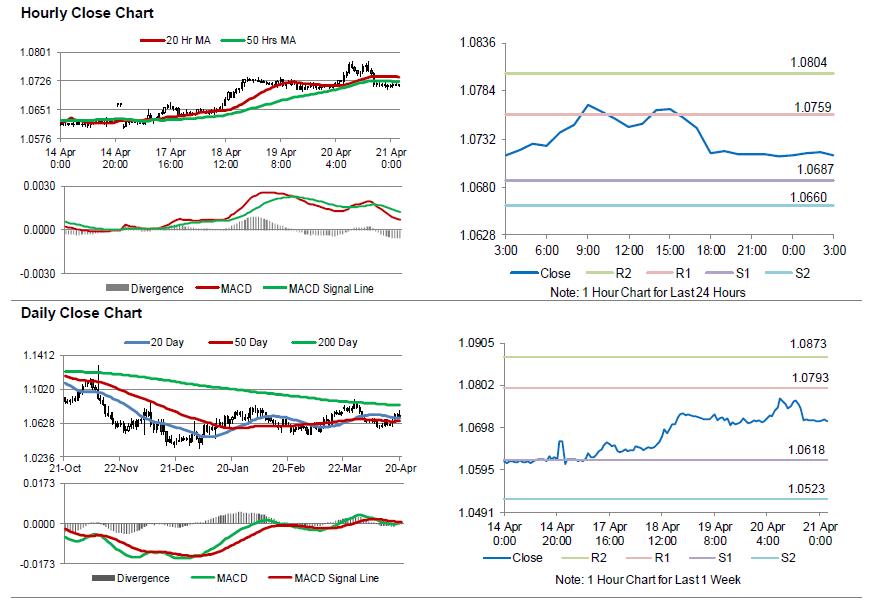

The pair is expected to find support at 1.0687, and a fall through could take it to the next support level of 1.0660. The pair is expected to find its first resistance at 1.0759, and a rise through could take it to the next resistance level of 1.0804.

Going ahead, investors will keenly await the release of preliminary Markit manufacturing and services PMIs data for April across the Euro-zone, slated to release in a few hours. Moreover, market participants will also eye the first-round of voting in French presidential election, scheduled this Sunday. In the US, the flash print of Markit manufacturing and services PMIs for April along with existing home sales for March, will garner a significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.