For the 24 hours to 23:00 GMT, the EUR declined 0.25% against the USD and closed at 1.1165.

On the data front, the Euro-zone’s final consumer confidence index rose to a level of -6.5 in May, in line with market expectations and compared to a revised reading of -7.3 in the prior month. Moreover, the economic sentiment indicator climbed to a level of 105.1 in May, more than market expectations for a gain to a level of 103.9. The indicator had recorded a revised reading of 103.9 in the previous month. Meanwhile, the nation’s business climate indicator eased to a level of 0.3 in May, compared to market anticipations for a fall to a level of 0.4. The indicator had recorded a level of 0.4 in the prior month.

Separately, in Germany, the Gfk consumer confidence index unexpectedly slid to a level of 10.1 in June, defying market consensus for a rise to a level of 10.4. In the previous month, the index had registered a revised reading of 10.2.

The US dollar gained ground against a basket of currencies, as rising US-China trade tensions, sparked fears of recession in the economy.

In the US, data showed that the CB consumer confidence index climbed to a six-month high level of 134.1 in May, following market anticipations for a gain to a level of 130.0. In the previous month, the index had registered a level of 129.2. Furthermore, the housing price index advanced 0.1% on a monthly basis in March, rising at its weakest pace in 7 years and undershooting market expectations for an increase of 0.2%. In the prior month, the index had registered a revised rise of 0.3%. Meanwhile, the US Dallas Fed manufacturing business index unexpectedly declined to a level of -5.3 in May, compared to market expectations for a gain to a level of 5.8. The index had recorded a reading of 2.0 in the prior month.

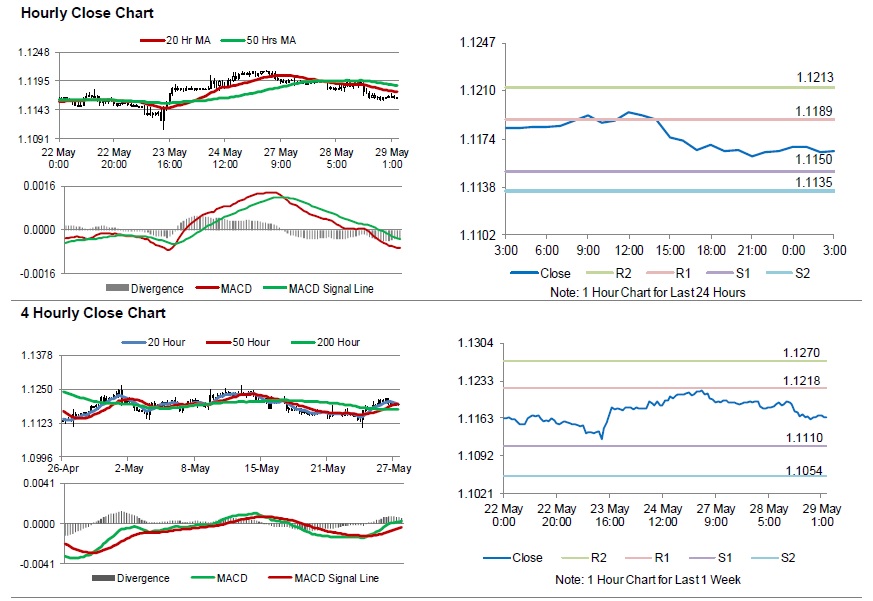

In the Asian session, at GMT0300, the pair is trading at 1.1165, with the EUR trading flat against the USD from yesterday’s close.

The pair is expected to find support at 1.1150, and a fall through could take it to the next support level of 1.1135. The pair is expected to find its first resistance at 1.1189, and a rise through could take it to the next resistance level of 1.1213.

Going forward, traders would keep an eye on Germany’s unemployment rate for May, set to release in a few hours. Later in the day, the US Richmond Fed manufacturing index for May and the MBA mortgage applications, will be on investors’ radar.

The currency pair is trading below with its 20 Hr and 50 Hr moving averages.