For the 24 hours to 23:00 GMT, the EUR rose 0.36% against the USD and closed at 1.1153.

On the data front, Euro-zone’s final consumer confidence index fell to a level of -7.6 in October, meeting market expectations and defying preliminary estimates for a steady reading. The index had registered a revised reading of -6.5 in the prior month. Moreover, the economic sentiment indicator fell to a level of 100.8 in October, more than market expectations. In the previous month, the indicator had registered a reading of 101.7. Meanwhile, the business climate indicator unexpectedly climbed to -0.19 in October, compared to a revised level of -0.23 in the previous month.

Separately, in Germany, the seasonally adjusted unemployment rate remained steady at 5.0% in October, at par with market expectations. Meanwhile the nation’s preliminary consumer price index (CPI) advanced of 1.1% on an annual basis in October, in line with market expectations and compared to a rise of 1.2% in the prior month.

In the US, data showed that the ADP private sector employment increased by 125.0K in October, compared to a revised rise of 93.0K in the previous month. Also, the preliminary annualised gross domestic product (GDP) climbed 1.9% on a quarterly basis in Q3 2019, higher than market expectations for an advance of 1.7%. In the previous quarter, the annualised GDP had registered a rise of 2.0%. Additionally, the nation’s MBA mortgage applications rose 0.6% on a weekly basis in the week ended 25 October 2019, following a drop of 11.9% in the prior week.

The Federal Reserve (Fed), in its latest monetary policy meeting, lowered its key interest rate for the third time this year by 25 basis points to a range of 1.5% to 1.75%, as widely expected and citing slowdown in the US economic growth and ongoing trade tensions. Additionally, the Fed downplayed expectations of further cuts for now and indicated that the central bank may put further monetary policy easing on hold.

In his post-meeting press conference, Fed Chairman, Jerome Powell, indicated that the central bank would keep interest rates steady for the foreseeable future, given the Fed’s economic outlook of moderate economic growth, a strong labour market and inflation growing at around 2.0%. Further, he stated that the current stance of monetary policy is “likely to remain appropriate” as long as “the outlook remains broadly in keeping with our expectations.”

In the Asian session, at GMT0400, the pair is trading at 1.1169, with the EUR trading 0.14% higher against the USD from yesterday’s close.

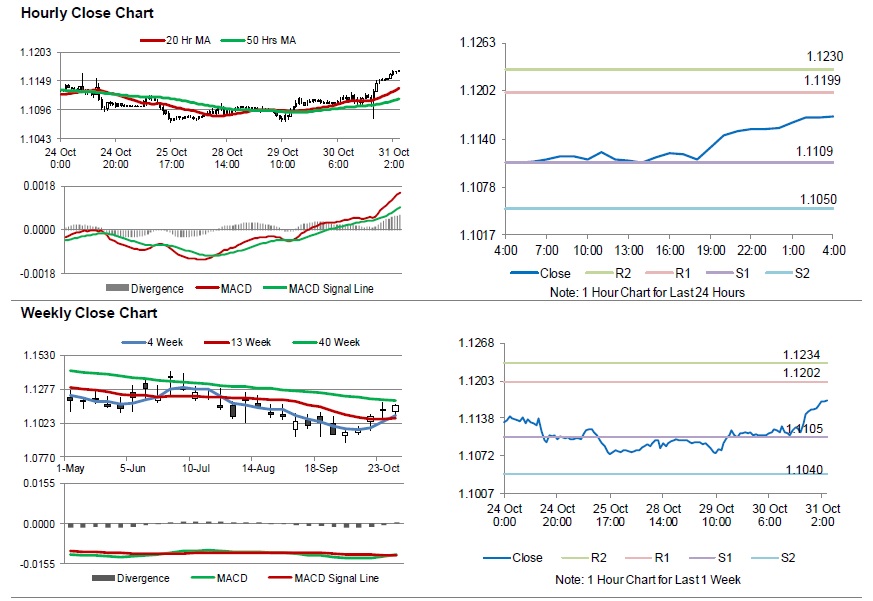

The pair is expected to find support at 1.1109, and a fall through could take it to the next support level of 1.1050. The pair is expected to find its first resistance at 1.1199, and a rise through could take it to the next resistance level of 1.1230.

Looking forward, traders would await Euro-zone’s consumer price index for October and unemployment rate for September along with gross domestic product for 3Q 2019, set to release in a few hours. Later in the day, the US personal income and personally spending, both for September followed by initial jobless claims and the Chicago Purchasing Managers’ Index for October, will keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.