For the 24 hours to 23:00 GMT, the EUR declined 0.51% against the USD and closed at 1.1152.

On the data front, Euro-zone’s preliminary consumer confidence index climbed to a level of -6.6 in July, compared to a level of -7.2 in the previous month.

The US Dollar rose against a basket of currencies yesterday, after President Donald Trump and US lawmakers reached a two-year deal lifting government borrowing limits to cover spending.

In the US, data showed that the Richmond Fed manufacturing index surprisingly declined to a six-year low level of -12.0 in July, defying market expectations for a rise to a level of 5.0. In the previous month, the index had registered a revised reading of 2.0. Moreover, the US existing home sales dropped 1.7% on monthly basis to a level of 5.27 million in June, more than market anticipations for a fall to level of 5.32 million. In the previous month, existing home sales had registered a revised level of 5.36 million. Further, the nation’s housing price index fell 0.1% on a monthly basis in May, compared to an advance of 0.4% in the previous month. Market participants had expected the index to register a rise of 0.4%.

Separately, the International Monetary Fund (IMF) slashed its global growth forecast to 3.2% in 2019 from 3.3% and forecasted a growth of 3.5% for 2020. Meanwhile, the IMF lifted its projection for US growth to 2.6% in 2019 and kept its 2020 growth outlook unchanged at 1.9%, citing concerns over the ongoing trade war. Additionally, the euro-area forecast was unrevised at 1.3%.

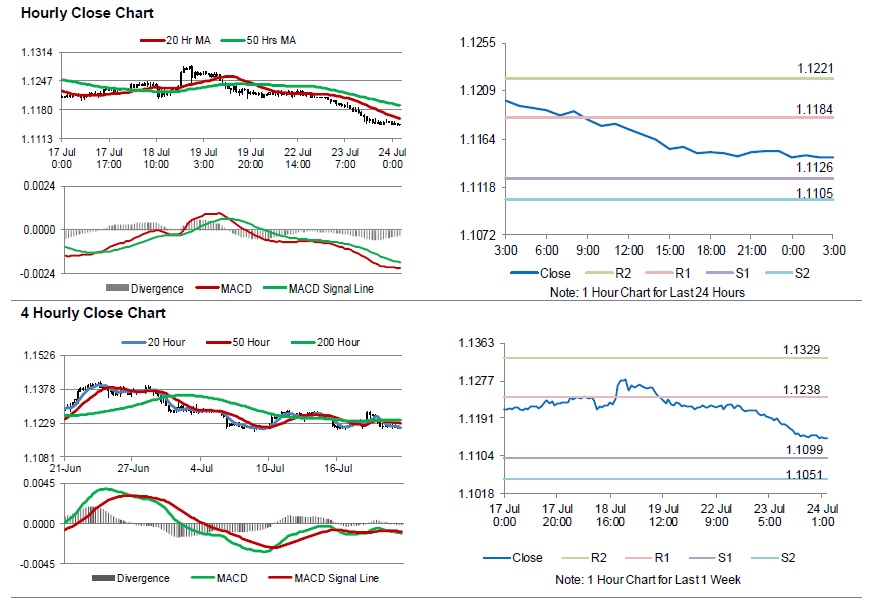

In the Asian session, at GMT0300, the pair is trading at 1.1146, with the EUR trading 0.05% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1126, and a fall through could take it to the next support level of 1.1105. The pair is expected to find its first resistance at 1.1184, and a rise through could take it to the next resistance level of 1.1221.

Looking ahead, traders would keep an eye on the Markit manufacturing and services PMIs for July, set to release across the euro bloc in a few hours. Later in the day, the US Markit manufacturing and services PMIs for July, new home sales for June along with the MBA mortgage applications, will be on investors’ radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.