For the 24 hours to 23:00 GMT, the EUR slightly rose against the USD and closed at 1.1010.

On the data front, Euro-zone’s final consumer confidence index advanced to a level of -7.2 in November, meeting market expectations and confirming the preliminary print. In the prior month, the index had recorded a revised level of -7.6. Moreover, the region’s economic sentiment indicator rose to a level of 101.3 in November, surpassing market expectations for an increase to a level of 101.0. In the prior month, the indicator had registered a level of 100.8. Further, the nation’s M3 money supply climbed 5.6% on a yearly basis in October. In preceding month, M3 money supply had recoded an advance of 5.5%. On the other hand, the business climate indicator unexpectedly fell to a level of -0.23 in November, compared to a revised reading of -0.20 in the previous month. Market participants had anticipation for the indicator to advance to a level of -0.14.

Separately, in Germany, the consumer price index (CPI) advanced 1.1% on an annual basis in November, less than market expectations for a rise of 1.3%. In the prior month, the CPI had registered a similar rise.

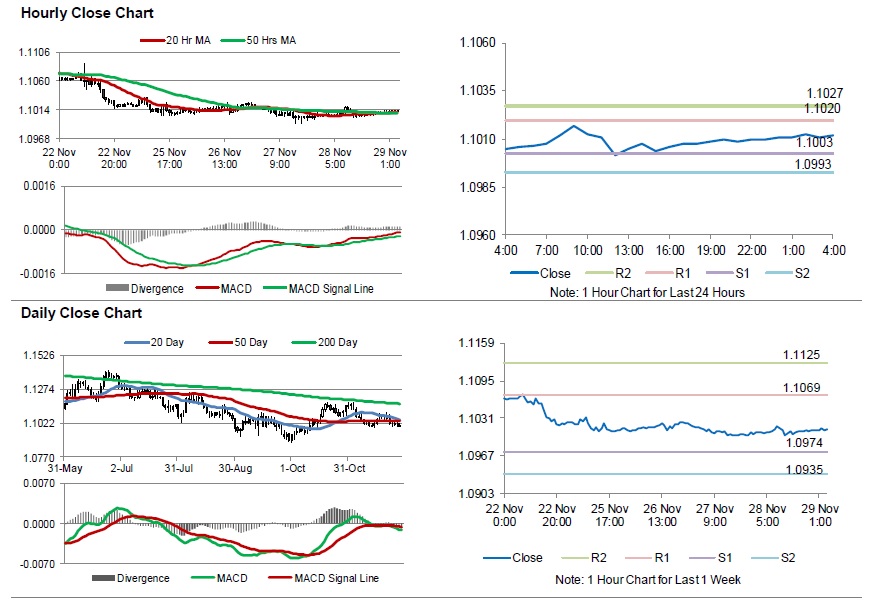

In the Asian session, at GMT0400, the pair is trading at 1.1012, with the EUR trading a tad higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1003, and a fall through could take it to the next support level of 1.0993. The pair is expected to find its first resistance at 1.1020, and a rise through could take it to the next resistance level of 1.1027.

Amid lack of macroeconomic releases in the US today, traders would focus on the Euro-zone’s CPI for November and unemployment rate for October along with Germany’s unemployment rate for November and retail sales for October, set to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.