For the 24 hours to 23:00 GMT, the EUR declined 0.34% against the USD and closed at 1.1222.

On the data front, the Euro-zone’s consumer confidence index surprisingly slid to a level of -7.9 in April, defying consensus of a rise to a level of -7.0. The index had registered a reading of -7.2 in the previous month.

The US dollar gained ground against major currencies, after upbeat US new home sales data diminished worries over the country’s economic slowdown.

In the US, new home sales surprisingly rose by 4.5% on monthly basis, to a level of 692.0K, marking its highest level in 1.5-years, supported by a decline in mortgage rates and house prices. New home sales had registered a revised level of 662.0K in the previous month, while the market participants had envisaged to record a level of 649.0K. Moreover, data showed that the housing price index climbed 0.3% on a monthly basis in February, undershooting market expectations for a gain of 0.5%. In the previous month, the index had registered a rise of 0.6%.

On the contrary, the US Richmond Fed manufacturing index unexpectedly eased to a level of 3.0 in April, defying market expectations of an unchanged reading. In the prior month, the index had recorded a reading of 10.0.

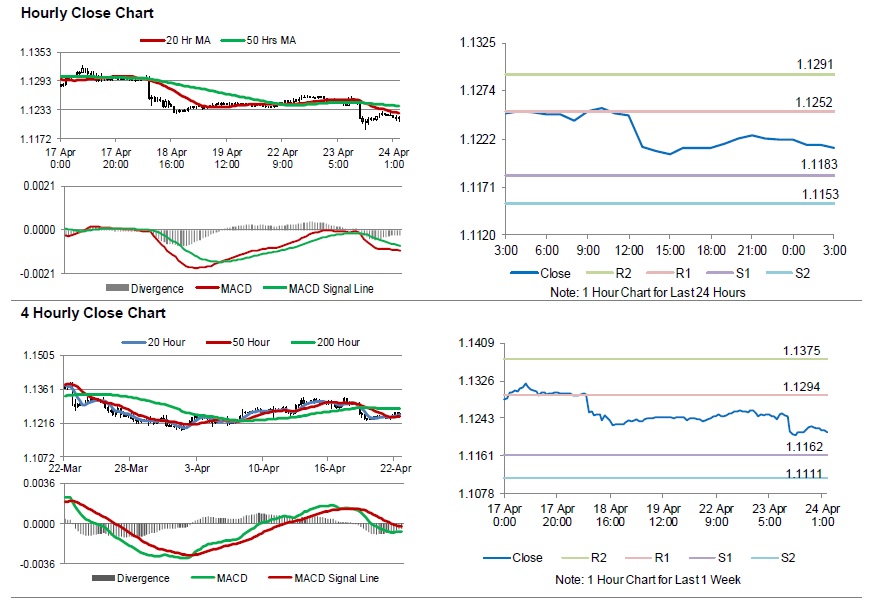

In the Asian session, at GMT0300, the pair is trading at 1.1213, with the EUR trading 0.08% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1183, and a fall through could take it to the next support level of 1.1153. The pair is expected to find its first resistance at 1.1252, and a rise through could take it to the next resistance level of 1.1291.

Going forward, investors would closely monitor Germany’s Ifo business climate, expectations and current assessment, all for April, slated to release in a few hours. Later in the day, the US MBA mortgage applications will garner significant amount of traders’ attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.