For the 24 hours to 23:00 GMT, the EUR rose 0.26% against the USD and closed at 1.0772, after the Euro-zone’s preliminary consumer confidence index improved to a level of -4.9 in January, notching its strongest level since April 2015, thus pointing towards continuous improvement in consumer sentiment. However, the index fell short of market expectations for a rise to a level of -4.8 and following a reading of -5.1 in the previous month.

Separately, according to the Bundesbank monthly report, German inflation is expected to hit 2.0% in January for the first time since 2014, on the back of a surge in crude prices.

The greenback weakened against a basket of major currencies, as concerns over the impact of US President, Donald Trump’s protectionist trade stance, continued to cast doubts over his policy-path.

In the Asian session, at GMT0400, the pair is trading at 1.0758, with the EUR trading 0.13% lower against the USD from yesterday’s close.

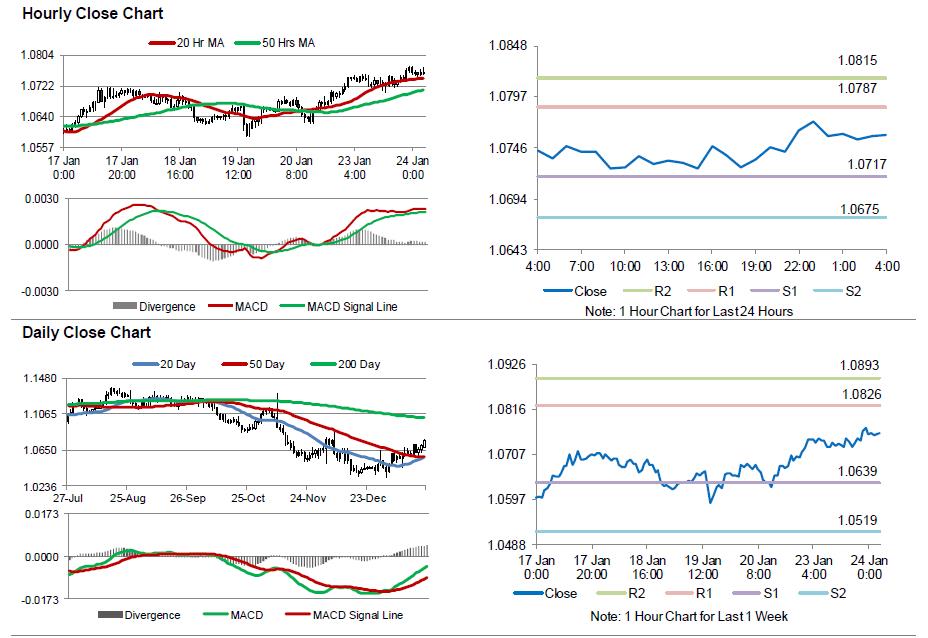

The pair is expected to find support at 1.0717, and a fall through could take it to the next support level of 1.0675. The pair is expected to find its first resistance at 1.0787, and a rise through could take it to the next resistance level of 1.0815.

Trading trend in the Euro will be governed by the release of the flash Markit manufacturing and services PMIs, both for January, across the Euro-zone. Moreover, the US preliminary Markit manufacturing PMI for January and existing home sales for December, will pique significant amount of investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.