For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.1868, despite a jump in Euro-zone’s consumer confidence index.

On the economic front, data showed that the flash consumer confidence index in the Euro-zone rose more-than-expected to a level of 0.5 in December, notching its highest level in 17 years, suggesting that consumers continued to enjoy a strong period of economic performance across the common currency region. The index had registered a revised level of 0.0 in the previous month, while markets had expected for an advance to a level of 0.2.

Macroeconomic data released in the US indicated that the final annualised gross domestic product (GDP) was revised lower to 3.2% on a quarterly basis in the third quarter of 2017, amid a slight weakness in consumer spending. Meanwhile the preliminary figures had indicated an advance of 3.3%. Nevertheless, it was the strongest reading in nearly three years. In the previous quarter, the nation’s GDP had climbed 3.1%. On the contrary, the nation’s initial jobless claims climbed to a level of 245.0K in the week ended 16 December, beating market consensus for a rise to a level of 233.0K and compared to a level of 225.0K in the prior week.

Other economic data revealed that the Philadelphia Fed manufacturing index unexpectedly advanced to a level of 26.2 in December, defying market expectations for a fall to a level of 21.0. The index had recorded a level of 22.7 in the previous month. Moreover, the nation’s leading indicator increased 0.4% in November, after recording a rise of 1.2% in the previous month, while investors had envisaged for a gain of 0.4%.

In the Asian session, at GMT0400, the pair is trading at 1.1850, with the EUR trading 0.15% lower against the USD from yesterday’s close, after Catalonian election results indicated a victory for separatists, thus threating to further escalate tensions between Barcelona and Madrid.

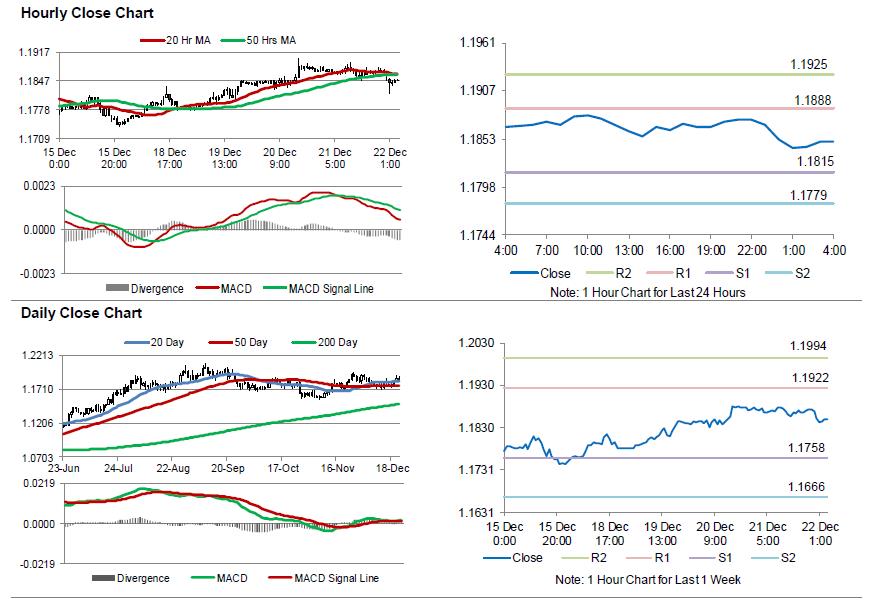

The pair is expected to find support at 1.1815, and a fall through could take it to the next support level of 1.1779. The pair is expected to find its first resistance at 1.1888, and a rise through could take it to the next resistance level of 1.1925.

Going ahead, market participants will draw their attention to the release of Germany’s GfK consumer confidence index for January, scheduled to release in a few hours. Also, the US flash durable goods orders, new home sales, personal income and spending data, all for November along with the Michigan Consumer Sentiment Index for December, slated to release later in the day, would pique significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.