For the 24 hours to 23:00 GMT, the EUR declined 0.50% against the USD and closed at 1.2282 on Friday.

Separately, the US dollar rose against a basket of currencies on Friday, boosted by higher US Treasury yields.

On the macro front, the Euro-zone’s flash consumer confidence index unexpectedly advanced to a level of 0.4 in April, defying market expectations for a drop to a level of -0.1. In the previous month, the index had registered a level of 0.1.

Separately, Germany’s producer price index (PPI) advanced less-than-anticipated by 1.9% on a yearly basis in March, compared to a rise of 1.8% in the prior month. Market participants had anticipated the PPI to climb 2.0%.

In the Asian session, at GMT0300, the pair is trading at 1.2275, with the EUR trading 0.06% lower against the USD from Friday’s close.

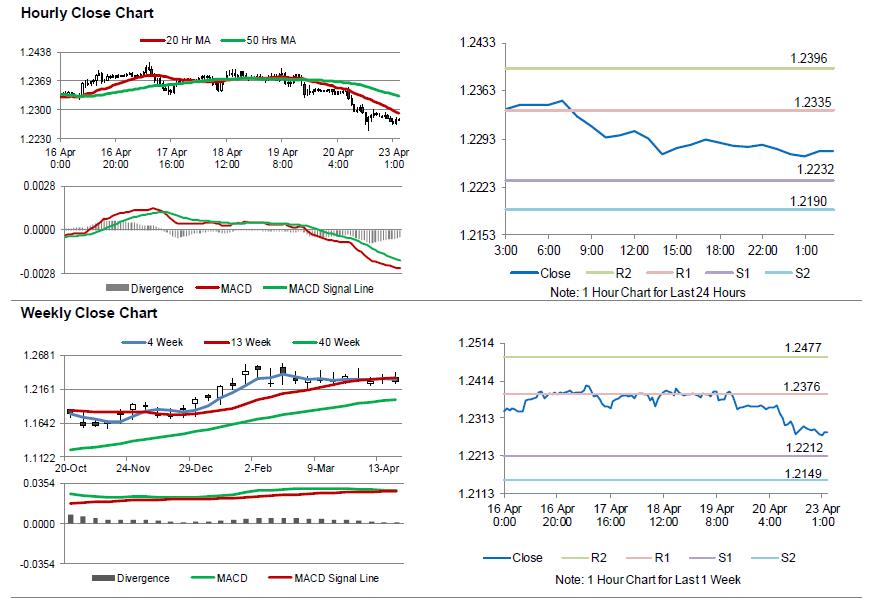

The pair is expected to find support at 1.2232, and a fall through could take it to the next support level of 1.2190. The pair is expected to find its first resistance at 1.2335, and a rise through could take it to the next resistance level of 1.2396.

Trading trend in the Euro today is expected to be determined by the flash Markit manufacturing and services PMIs data for April, scheduled to release across the Euro-zone in a few hours. Moreover, the US flash Markit manufacturing and services PMIs for April as well as existing home sales data for March, due to release later in the day, will keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.