For the 24 hours to 23:00 GMT, the EUR rose 0.48% against the USD and closed at 1.1439 on Friday.

On the macro front, Euro-zone’s consumer price index rose 0.3% in June, compared to a drop of 0.1% in the prior month. The preliminary figures had recorded an advance of 0.3%. Additionally, construction output surged 27.9% on a monthly basis in May, compared to a revised drop of 18.3% in the prior month.

In the US, building permits rose 2.1% to an annual rate of 1.24 million on a monthly basis in June, compared to a revised reading of 1.21 million in the prior month. Additionally, housing starts surged 17.3% to an annual rate of 1.18 million on the monthly in June, compared to a revised reading of 1.01 million in the earlier month. Meanwhile, the Michigan consumer sentiment index unexpectedly dropped to 73.2 in July, defying market expectations for a rise to a level of 79.0 and compared to a reading of 78.1 in the earlier month.

In the Asian session, at GMT0300, the pair is trading at 1.1418, with the EUR trading 0.18% lower against the USD from Friday’s close.

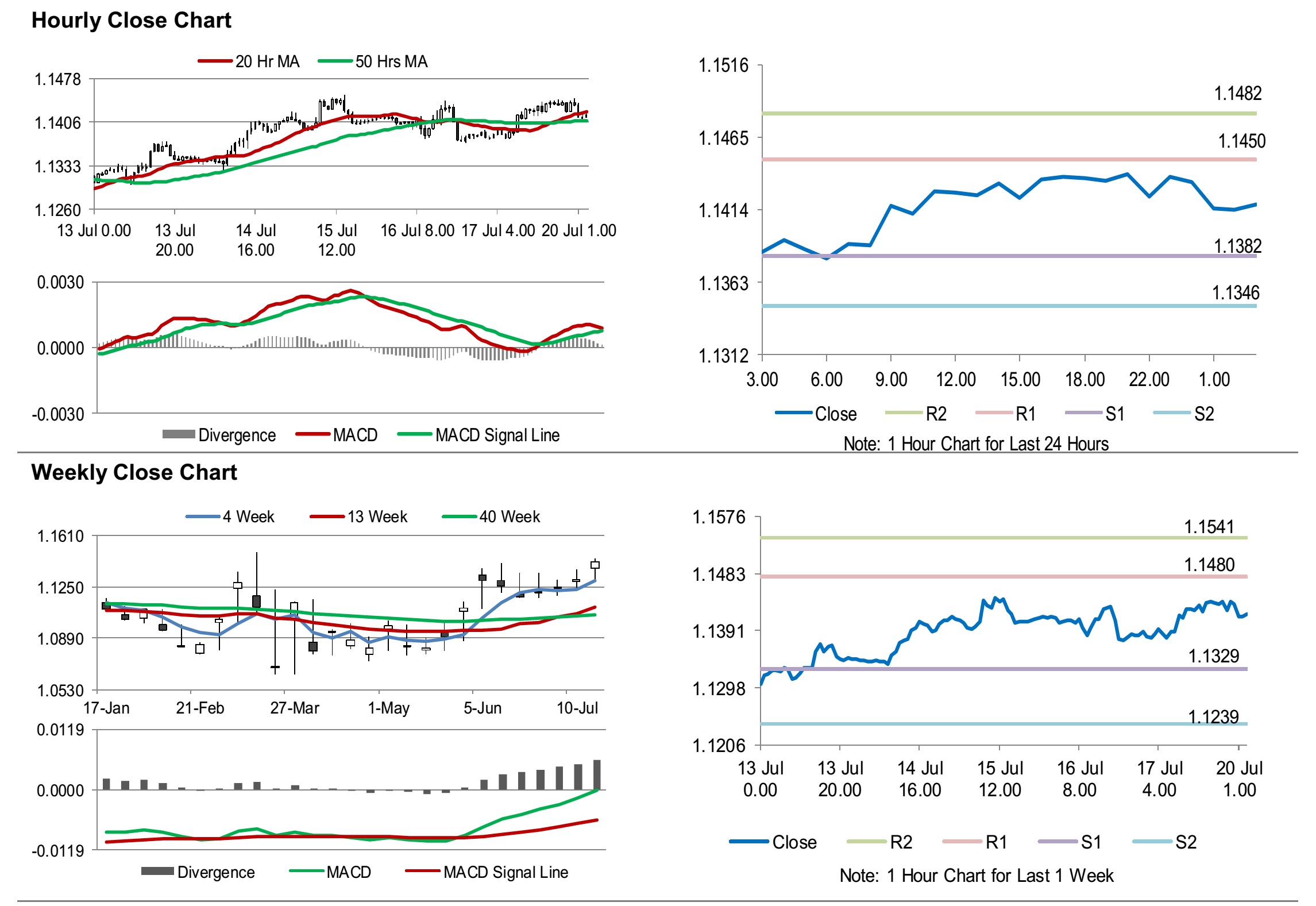

The pair is expected to find support at 1.1382, and a fall through could take it to the next support level of 1.1346. The pair is expected to find its first resistance at 1.1450, and a rise through could take it to the next resistance level of 1.1482.

Going forward, traders would keep a watch on Euro-zone’s current account for May, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.