For the 24 hours to 23:00 GMT, the EUR rose 0.75% against the USD and closed at 1.1409 on Friday

In economic news, the Euro-zone’s final consumer price index climbed to a six-year high level of 2.2% on a yearly basis in October, meeting market expectations and compared to a gain of 2.1% in the prior month. The preliminary figures had indicated a rise to 2.1%.

The European Central Bank (ECB) President, Mario Draghi stated that the Eurozone’s economy has slowed in recent months, however, he sees “no reason” for the economy to stop expanding. Further, he expects the current expansion to remain “resilient” and inflation to not rise as quickly as earlier expected. Draghi reiterated that the central bank would stick to its plan to end its stimulus program at the end of this year. Further, he warned that uncertainties around the medium-term outlook have increased significantly.

The US dollar fell against a basket of currencies, as the Federal Reserve’s policymakers expressed concerns over the global economic slowdown and made cautious comments on the outlook for interest rate hikes.

In the US, data showed that US manufacturing production rose 0.3% on a monthly basis in October, more than market expectations for a rise of 0.2%. In the previous month, manufacturing production had registered a similar revised rise. Meanwhile, the nation’s industrial production advanced 0.1% on a monthly basis in October, undershooting market consensus for a rise of 0.2%. Industrial production had recorded a revised increase of 0.2% in the preceding month.

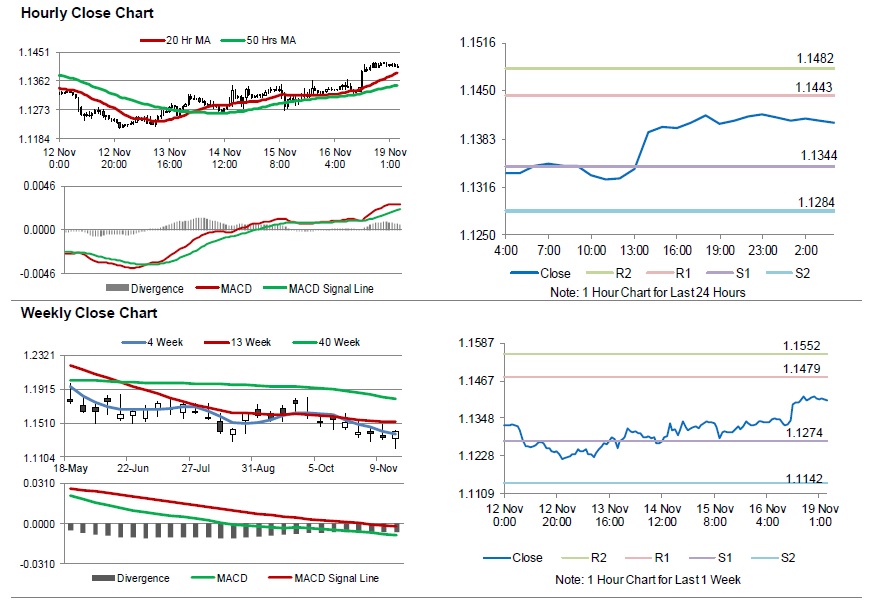

In the Asian session, at GMT0400, the pair is trading at 1.1405, with the EUR trading a tad lower against the USD from Friday’s close.

The pair is expected to find support at 1.1344, and a fall through could take it to the next support level of 1.1284. The pair is expected to find its first resistance at 1.1443, and a rise through could take it to the next resistance level of 1.1482.

Looking forward, traders would keep an eye on the Euro zone’s construction output for September, set to release in a few hours. Later in the day, the US NAHB housing market index for November, will garner significant amount of investors’ attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.