For the 24 hours to 23:00 GMT, the EUR declined 0.12% against the USD and closed at 1.1161 on Friday, ahead of the upcoming European parliamentary elections next week.

On the data front, the Euro-zone’s final consumer price index (CPI) advanced 1.7% on an annual basis in April, meeting market expectations and confirming the preliminary print. In the prior month, the CPI had recorded a rise of 1.4%. Moreover, the nation’s seasonally adjusted construction output declined 0.3% on a monthly basis in March, amid slowdown in building activities and following a gain of 3.0% in the preceding month.

In the US, data indicated that the flash Reuters/Michigan consumer sentiment index climbed to 102.4 in May, notching its highest level in 15 years and beating market expectations for a rise to a level of 97.5. In the previous month, the index had recorded a reading of 97.2.

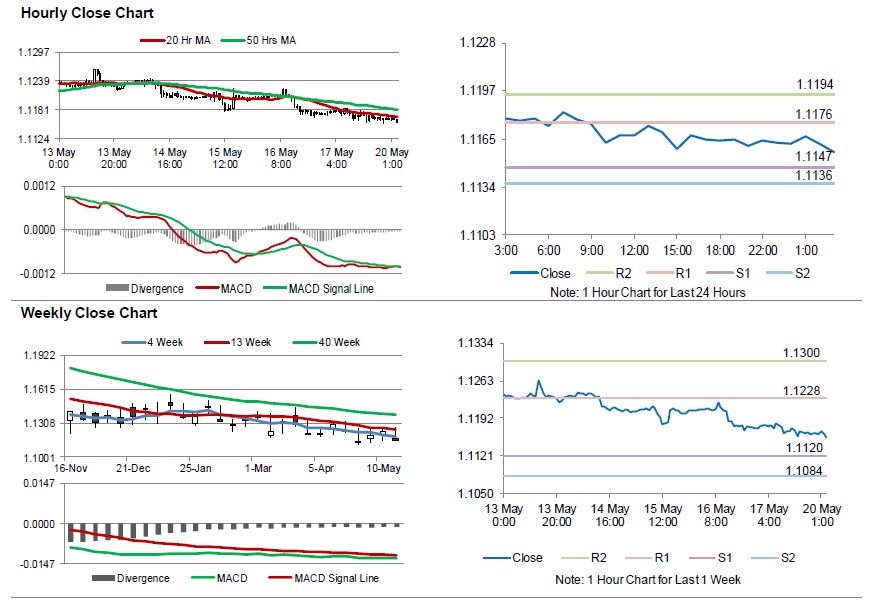

In the Asian session, at GMT0300, the pair is trading at 1.1157, with the EUR trading slightly lower against the USD from Friday’s close.

The pair is expected to find support at 1.1147, and a fall through could take it to the next support level of 1.1136. The pair is expected to find its first resistance at 1.1176, and a rise through could take it to the next resistance level of 1.1194.

Moving ahead, traders would keep an eye on Germany’s producer price index for April, set to release in a few hours. Later in the day, the US Chicago Fed national activity index for April, will garner significant amount of investors’ attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.