For the 24 hours to 23:00 GMT, the EUR rose 0.07% against the USD and closed at 1.1253.

Macroeconomic data showed that Euro-zone’s final consumer price inflation slowed to 1.2% on an annual basis in May, compared to market consensus for a rise of 1.3%. In the previous month, the inflation had recorded a level of 1.7%. Moreover, the region’s unemployment rate unexpectedly dropped to a decade low rate of 7.6% in April, compared to 7.7% in the prior month. Market participants had anticipated the unemployment rate to record an unchanged reading.

In the US, data indicated that factory orders fell 0.8% on a monthly basis in April, compared to a revised rise of 1.3% in the prior month. Market participants had envisaged factory orders to register a fall of 1.0%. Further, the nation’s final durable goods orders slid 2.1% on a monthly basis in April, confirming the preliminary print. In the prior month, durable goods orders had recorded a revised gain of 1.7%.

The Federal Reserve Chairman, Jerome Powell signalled that the central bank will cut its key interest rates if necessary. Additionally, he pledged that the bank will take appropriate actions to sustain the US economic expansion. However, Powell expressed concerns over the impact of trade and tariff tensions on the economy.

In the Asian session, at GMT0300, the pair is trading at 1.1262, with the EUR trading 0.08% higher against the USD from yesterday’s close.

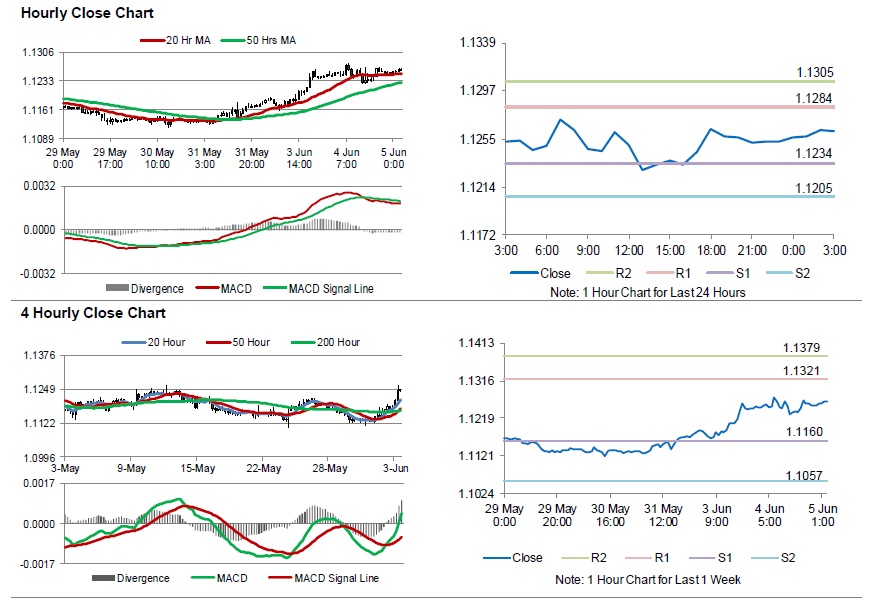

The pair is expected to find support at 1.1234, and a fall through could take it to the next support level of 1.1205. The pair is expected to find its first resistance at 1.1284, and a rise through could take it to the next resistance level of 1.1305.

Going forward, traders would keep an eye on Euro-zone’s producer price index and retail sales, both for April along with the Markit services PMI for May, slated to release across the euro bloc. Later in the day, the US ADP employment change, the Markit services PMI and the ISM non-manufacturing/services composite index, all for May, along with the MBA mortgage applications will pique significant amount of investors’ attention. Also, the US Federal Reserve’s Beige Book release, will be on investors radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.