For the 24 hours to 23:00 GMT, the EUR declined 0.71% against the USD and closed at 1.1078.

On the macro front, Euro-zone’s seasonally adjusted flash gross domestic product (GDP) climbed 1.1% on an annual basis in 2Q 2019, surpassing market expectations for a rise of 1.0%. In the prior quarter, GDP had registered a gain of 1.2%. Meanwhile, the final consumer price inflation slowed to 1.1% on an annual basis in July, marking its lowest level in 17-months and meeting market consensus. In the prior month, the inflation had recorded a level of 1.3%. Meanwhile, the region’s unemployment rate declined to a 11-year low of 7.5% in June, in line with market expectations. In the prior month, the unemployment rate had recorded a revised rate of 7.6%.

Separately, in Germany, the seasonally adjusted unemployment rate remained unchanged at 5.0% in July, at par with market expectations. Meanwhile, the nation’s retail sales jumped 3.5% on a monthly basis in June, rising by the most in 12 years and higher than market expectations for a rise to a level of 0.5%. In the preceding month, retail sales had recorded a revised fall of 1.7%.

The US dollar gained ground against its major peers, after the US Federal Reserve (Fed) cut interest rates as expected and Fed Chairman Jerome Powell ruled out prolonged easing cycle.

The Federal Reserve (Fed), at its latest monetary policy meeting, cut its benchmark interest rate for the first time since 2008 to a range of 2.00% to 2.25%, citing global economic concerns and muted US inflation. Further, the central bank stated that it will act as appropriate to sustain the US economic expansion. Meanwhile, the US Fed Chairman, Jerome Powell, stated that the rate cut was a ‘midcycle adjustment,’ and hence he does not guarantee future rate cuts.

In the US, data showed that the ADP private sector employment rose by 156.0K in July, compared to market expectations for a rise of 150.0K. The private sector employment had registered a revised increase of 112.0K in the prior month.

On the contrary, the US Chicago Fed Purchasing Managers’ Index unexpectedly fell to a level of 44.4 in July, defying market expectations for a rise to a level of 51.0. The index had registered a level of 49.7 in the previous month. Further, the nation’s mortgage applications eased to its lowest level since March by 1.4% on a weekly basis in the week ended 26 July 2019, following a drop of 1.9% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.1049, with the EUR trading 0.26% lower against the USD from yesterday’s close.

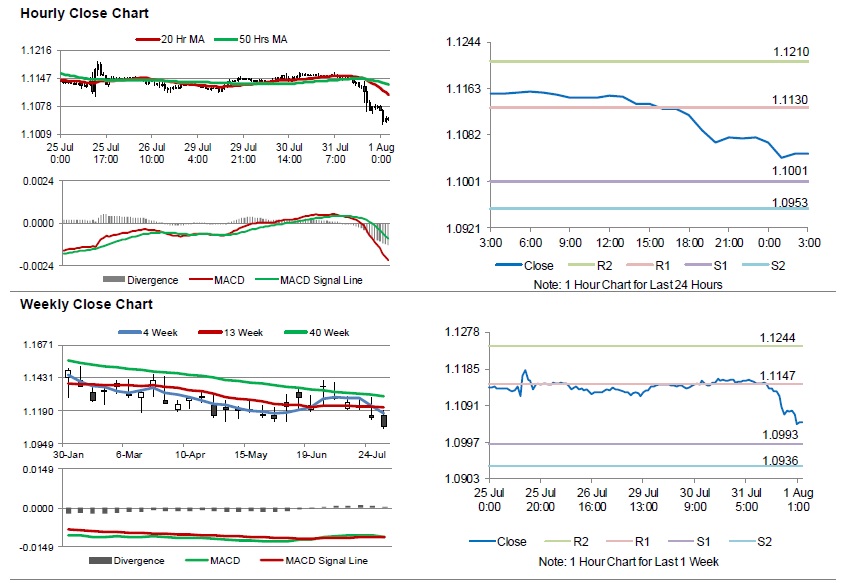

The pair is expected to find support at 1.1001, and a fall through could take it to the next support level of 1.0953. The pair is expected to find its first resistance at 1.1130, and a rise through could take it to the next resistance level of 1.1210.

Looking ahead, traders would await the Markit manufacturing PMI for July, set to release across the euro bloc. Later in the day, the US Markit manufacturing PMI and the ISM manufacturing index, both for July, construction spending for June followed by initial jobless claims, will keep traders on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.