For the 24 hours to 23:00 GMT, the EUR rose 0.05% against the USD and closed at 1.1168.

In economic news, the Euro-zone’s seasonally adjusted current account surplus unexpectedly narrowed to €24.7 billion in March, compared to a revised surplus of €27.8 billion in the previous month.

Separately, in Germany, the producer price index (PPI) rose 2.5% on an annual basis in April, surpassing market consensus for a rise of 2.4%. The PPI had recorded an advance of 2.4% in the previous month.

In the US, data showed that the Chicago Fed national activity index fell to a level of -0.5 in April, citing decline in factory output and higher than market anticipations for a drop to a level of -0.2. In the prior month, the index had registered a revised level of 0.1.

The US Federal Reserve Chairman, Jerome Powell, warned over the rising levels of business debt. However, he stated that it does not pose a larger threat to the financial system and considers the risks to be “moderate”.

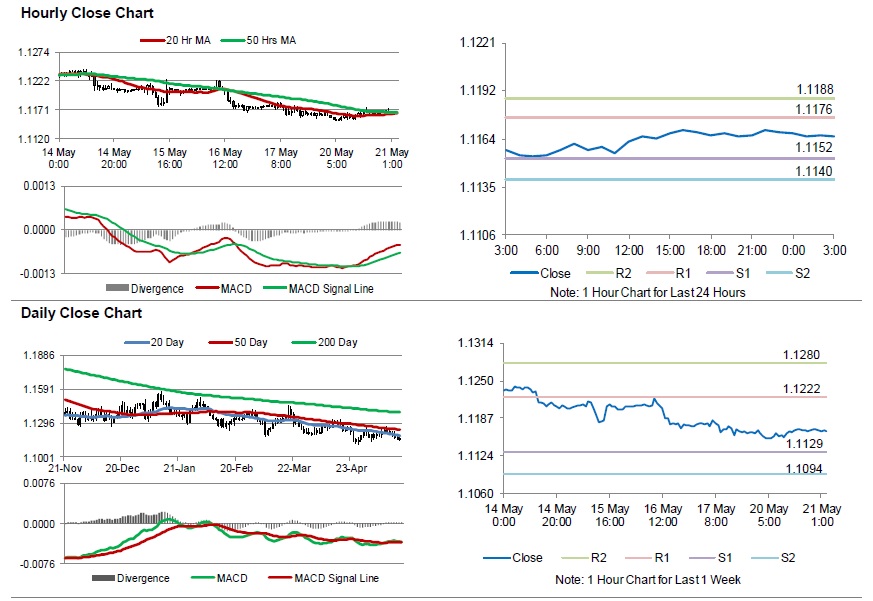

In the Asian session, at GMT0300, the pair is trading at 1.1165, with the EUR trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1152, and a fall through could take it to the next support level of 1.1140. The pair is expected to find its first resistance at 1.1176, and a rise through could take it to the next resistance level of 1.1188.

Looking ahead, traders would await the Euro-zone’s consumer confidence index for May, along with the OECD economic outlook, scheduled to release in a few hours. Later in the day, the US existing home sales for April, will be on investors radar.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.