For the 24 hours to 23:00 GMT, the EUR declined 0.65% against the USD and closed at 1.1770 on Friday.

In economic news, the Euro-zone’s seasonally adjusted current account surplus notched its highest level since May 2016 in August, after it widened to €33.3 billion, boosted by larger exports of goods. The region had registered a revised surplus of €31.5 billion in the prior month.

The greenback advanced against its major counterparts, on the back of renewed optimism over the US President, Donald Trump’s tax reforms plans, after the US Senate approved a budget blueprint.

On the macro front, existing home sales in the US unexpectedly rebounded 0.7% on a monthly basis to a level of 5.39 million in September, defying market expectations for a fall to a level of 5.30 million and after registering a level of 5.35 million in the previous month.

Meanwhile, the Federal Reserve (Fed) Chairwoman, Janet Yellen, warned that there is an “uncomfortably high” risk that the central bank may have to deploy crisis-era unconventional policy tools again if the US economy remains stuck in a low interest-rate regime. Further, Yellen also noted that the Fed is making “good progress” in reducing its massive portfolio of bond holdings.

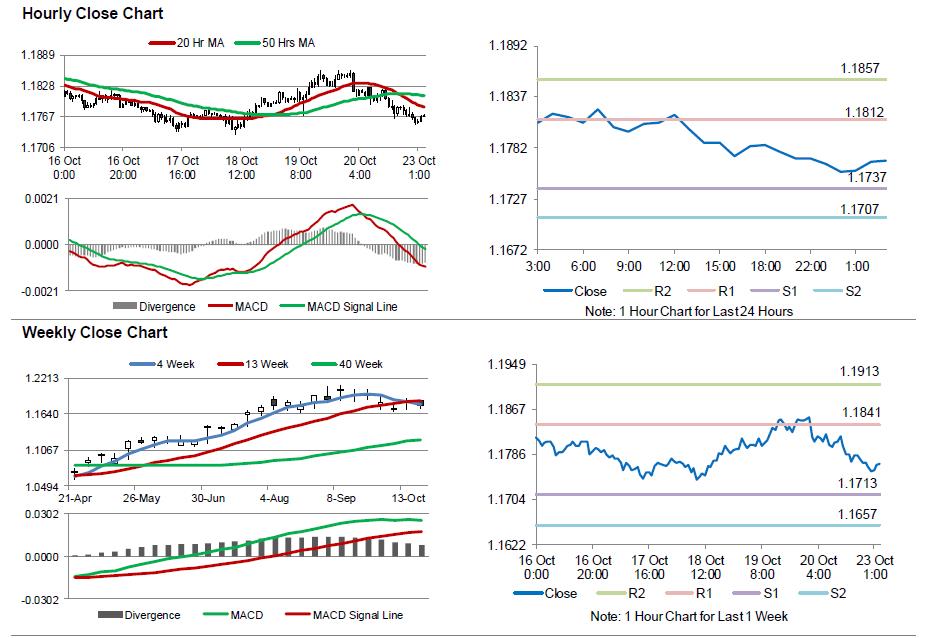

In the Asian session, at GMT0300, the pair is trading at 1.1768, with the EUR trading marginally lower against the USD from Friday’s close.

The pair is expected to find support at 1.1737, and a fall through could take it to the next support level of 1.1707. The pair is expected to find its first resistance at 1.1812, and a rise through could take it to the next resistance level of 1.1857.

Moving ahead, investors would eye the Euro-zone’s flash consumer confidence index for October, slated to release later today. Further, the US Chicago Fed national activity index for September, due to release later in the day, will be on investors’ radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.