For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.0664 on Friday.

On the macro front, Euro-zone’s seasonally adjusted current account surplus widened to €34.7 billion in January, less than market forecast for a surplus of €35.5 billion and compared to a surplus narrowed to €32.6 billion in the previous month. Separately, Germany’s producer price index unexpectedly slid 0.1% on a yearly basis in February, defying market anticipations for a rise of 0.2% and compared to an advance of 0.2% in the prior month.

In the US, existing home sales climbed 6.5% on a monthly basis to an annual rate of 5.77 million in February, hitting its highest level in 13 years and beating market consensus for a level of 5.50 million. In the previous month, existing home sales had recorded a level of 5.46 million.

In the Asian session, at GMT0400, the pair is trading at 1.0724, with the EUR trading 0.56% higher against the USD from Friday’s close.

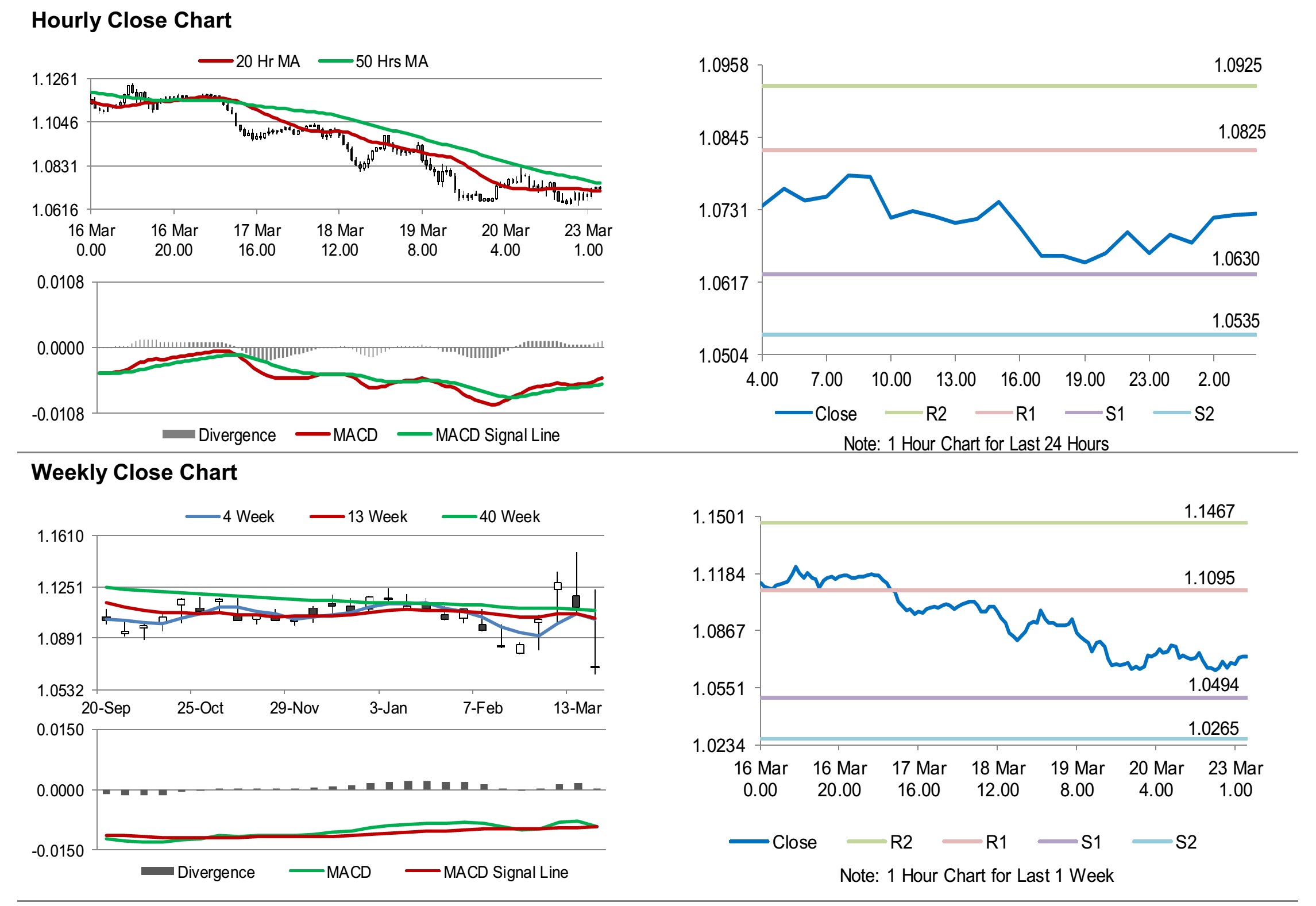

The pair is expected to find support at 1.0630, and a fall through could take it to the next support level of 1.0535. The pair is expected to find its first resistance at 1.0825, and a rise through could take it to the next resistance level of 1.0925.

Looking forward, participants would keep a close eye on Euro-zone’s consumer confidence for March, slated to release later today. Separately, the US Chicago Fed National Activity Index for February, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.