For the 24 hours to 23:00 GMT, the EUR rose 0.21% against the USD and closed at 1.0585.

On the economic front, the Euro-zone’s final consumer confidence index dropped to a level of -6.2 in February, at par with market expectations and confirming the preliminary print. The index had recorded a revised level of -4.8 in the prior month. On the other hand, the region’s business climate indicator rose more-than-anticipated to a level of 0.82 in February, surging to its highest level since June 2011, thus suggesting that firms remained upbeat about the region’s economic growth. The index had registered a revised reading of 0.76 in the prior month. Moreover, the region’s economic confidence index advanced to a nearly 6-year high level of 108.0 in February, highlighting that the common currency region is gathering economic momentum in the first quarter of 2017. The index registered a level of 107.9 in the previous month, while markets were expecting for a rise to a level of 108.1. Further, the region’s services confidence index improved sharply to a level of 13.8 in February, pushing the index to its highest level since October 2007 and following a revised level of 12.8 in the prior month.

Macroeconomic data indicated that pending home sales in US surprisingly dropped 2.8% on a monthly basis in January, plummeting to its lowest level in 12 months and compared to a revised rise of 0.8% in the prior month. Markets were anticipating pending home sales to gain 0.6%. On the contrary, the nation’s flash durable goods orders rebounded 1.8% MoM in January, on the back of a pick-up in demand for commercial and military aircrafts. Durable goods orders had fallen 0.5% in the prior month, whereas investors’ had envisaged for a rise of 1.6%. Further, the nation’s Dallas Fed manufacturing business index unexpectedly climbed to a level of 24.5 in February, confounding market consensus for a fall to a level of 19.4 and after recording a level of 22.1 in the previous month.

Meanwhile, the Dallas Fed President, Robert Kaplan, stated that the Federal Reserve might need to raise interest rates in the near future to avoid overheating of the economy.

In the Asian session, at GMT0400, the pair is trading at 1.0585, with the EUR trading flat against the USD from yesterday’s close.

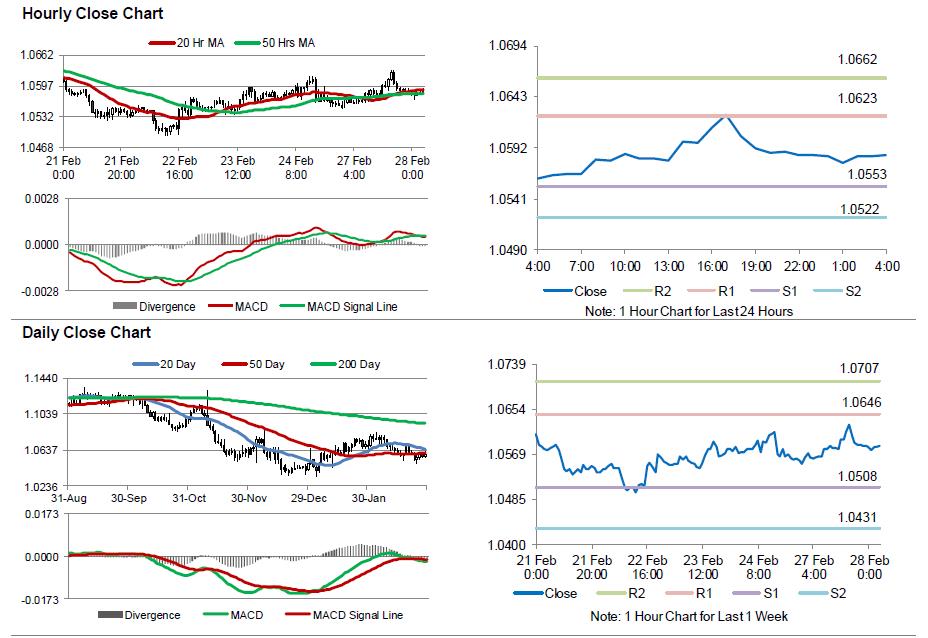

The pair is expected to find support at 1.0553, and a fall through could take it to the next support level of 1.0522. The pair is expected to find its first resistance at 1.0623, and a rise through could take it to the next resistance level of 1.0662.

Moving ahead, traders will focus on Germany’s retail sales data for January, scheduled to release in a few hours. Moreover, a string of crucial economic releases in the US, consisting of the flash annualised 4Q GDP, goods trade balance for January and consumer confidence for February, all slated to release later today, will pique significant amount of market attention.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.