For the 24 hours to 23:00 GMT, the EUR declined 0.25% against the USD and closed at 1.1776, after Germany’s seasonally adjusted industrial production unexpectedly declined 1.4% on a monthly basis in October, posting its biggest drop in 2017 and confounding market expectations for a gain of 0.9%. Industrial production had registered a revised fall of 0.9% in the prior month.

Separately, the Euro-zone’s seasonally adjusted final gross domestic product (GDP) advanced 0.6% on a quarterly basis in the third quarter of 2017, confirming the preliminary print. The region’s GDP had climbed by a revised 0.7% in the prior quarter.

The greenback advanced against its major peers, amid optimism that the US Government would push through its long-anticipated tax reforms.

Gains in the US Dollar were boosted further, after data showed that first time claims for the US unemployment benefits unexpectedly eased to a level of 236.0K in the week ended 02 December, hitting its lowest level in five weeks and pointing to a strong labour market. Markets were anticipating initial jobless claims to climb to a level of 240.0K, compared to a level of 238.0K in the prior week. Further, the nation’s consumer credit increased more-than-anticipated by $20.52 billion in October, posting its largest increase in 11 months. Consumer credit had registered a revised rise of $19.21 billion in the previous month, while market participants had envisaged for an advance of $17.50 billion.

In the Asian session, at GMT0400, the pair is trading at 1.1768, with the EUR trading 0.07% lower against the USD from yesterday’s close.

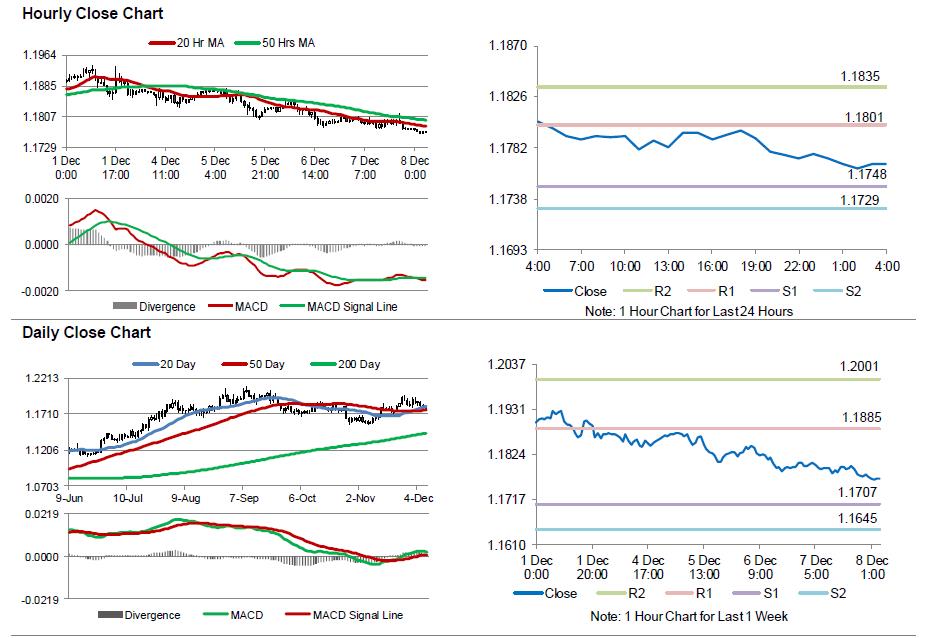

The pair is expected to find support at 1.1748, and a fall through could take it to the next support level of 1.1729. The pair is expected to find its first resistance at 1.1801, and a rise through could take it to the next resistance level of 1.1835.

Moving ahead, traders would eye the release of Germany’s trade balance figures for October, due to release in a few hours. Later in the day, investors would direct their attention to the crucial US non-farm payrolls, unemployment rate and average hourly earnings data, all for November, to get better insights into the nation’s labour market.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.