For the 24 hours to 23:00 GMT, the EUR rose 0.21% against the USD and closed at 1.1160, after Germany’s seasonally adjusted flash gross domestic product (GDP) rose more-than-expected by 0.4% on a quarterly basis in 2Q 2016, compared to an advance of 0.7% in the prior quarter while markets expected it to expand by 0.2%. Moreover, the nation’s final consumer price index advanced 0.3% on a monthly basis in July, at par with market expectations and following a similar rise in the preliminary print. Separately, Euro-zone’s seasonally adjusted preliminary GDP expanded 0.3% QoQ in the second quarter, in line with market expectations, growing at its slowest pace since the middle of 2015, as risks related to the outcome of European Union (EU) referendum clouded the region’s economic outlook. Meanwhile, the region’s seasonally adjusted industrial production rebounded by 0.6% on a monthly basis in June, beating market expectations for an advance of 0.5% and compared to a fall of 1.2% in the previous month.

Macroeconomic data released in the US indicated that, advance retail sales remained flat on a monthly basis in July, defying market expectations for a rise of 0.4% and after recording a revised rise of 0.8% in the prior month. Further, the nation’s flash Michigan consumer confidence index rose less-than-expected to a level of 90.4 in August, compared to a level of 90.0 in the prior month while markets anticipated the index to advance to a level of 91.5.

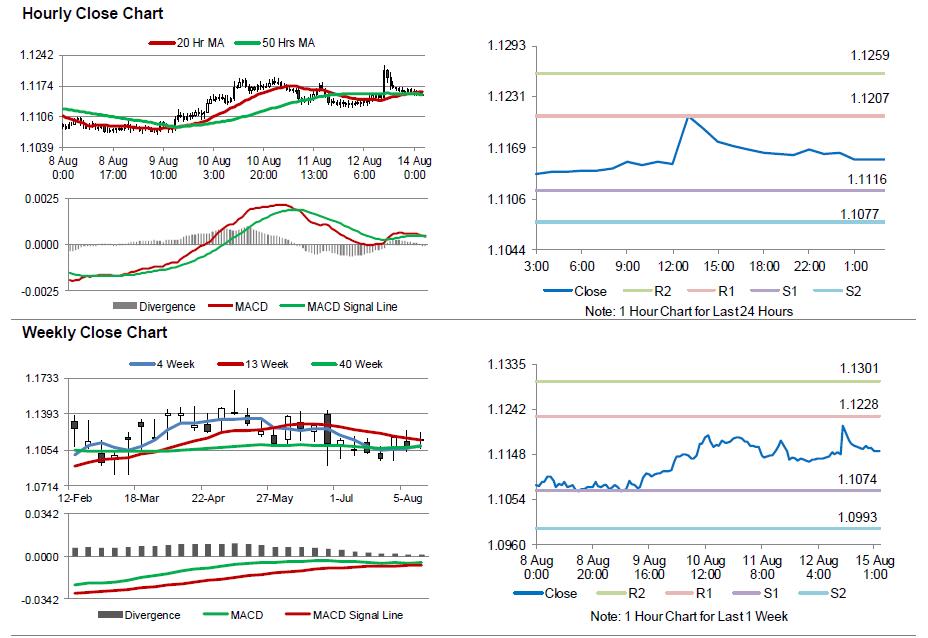

In the Asian session, at GMT0300, the pair is trading at 1.1154, with the EUR trading marginally lower against the USD from Friday’s close.

The pair is expected to find support at 1.1116, and a fall through could take it to the next support level of 1.1077. The pair is expected to find its first resistance at 1.1207, and a rise through could take it to the next resistance level of 1.1259.

Moving ahead, investors would look forward to the US NAHB housing market index data for August, slated to release later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.