For the 24 hours to 23:00 GMT, the EUR declined 0.15% against the USD and closed at 1.0577, after gross domestic product (GDP) figures across the Euro-zone disappointed with a weaker than estimated growth.

Data showed that the Euro-zone’s seasonally adjusted second estimate of GDP was revised down to 0.4% on a quarterly basis in 4Q 2016, from a preliminary estimate of 0.5%. In the previous quarter, GDP had registered a revised similar rise of 0.4%. Moreover, the region’s ZEW economic sentiment index dropped more-than-expected to a level of 17.1 in February, compared to a reading of 23.2 in the prior month. Further, the region’s seasonally adjusted industrial production eased 1.6% MoM in December, compared to a revised rise of 1.5% in the prior month.

Separately, Germany’s seasonally adjusted flash GDP advanced 0.4% on a quarterly basis in the fourth quarter of 2016, falling short of market consensus for a rise of 0.5% and after recording a rise of 0.2% in the prior quarter. Meanwhile, the nation’s final consumer price index climbed 1.9% on an annual basis in January, confirming the preliminary estimates and compared to a rise of 1.7% in the previous month.

On the other hand, the nation’s ZEW economic sentiment index deteriorated to a four-month low level of 10.4 in February, as concerns over Brexit, political uncertainty in Europe and the future US economic policy depressed investor sentiment. Investors had envisaged for a fall to a level of 15.0, following a level of 16.6 in the prior month.

The greenback gained ground against most of its key counterparts, after the US Federal Reserve (Fed) Chair, Janet Yellen, struck a hawkish tone on the timing of next interest rate hike.

The Fed Chairwoman, in a testimony to the Senate Banking Committee, stated that the central bank will probably need to raise interest rates at upcoming meetings, as unnecessary delay would be “unwise” as the US economy is showing signs of continuous growth. However, she flagged considerable uncertainty over economic policy under the Trump administration.

Separately, the Atlanta Fed President, Dennis Lockhart, suggested that the central bank should not rush to raise interest rates and instead evaluate how the new Trump administration’s policies may affect the economy.

In the Asian session, at GMT0400, the pair is trading at 1.0583, with the EUR trading 0.06% higher against the USD from yesterday’s close.

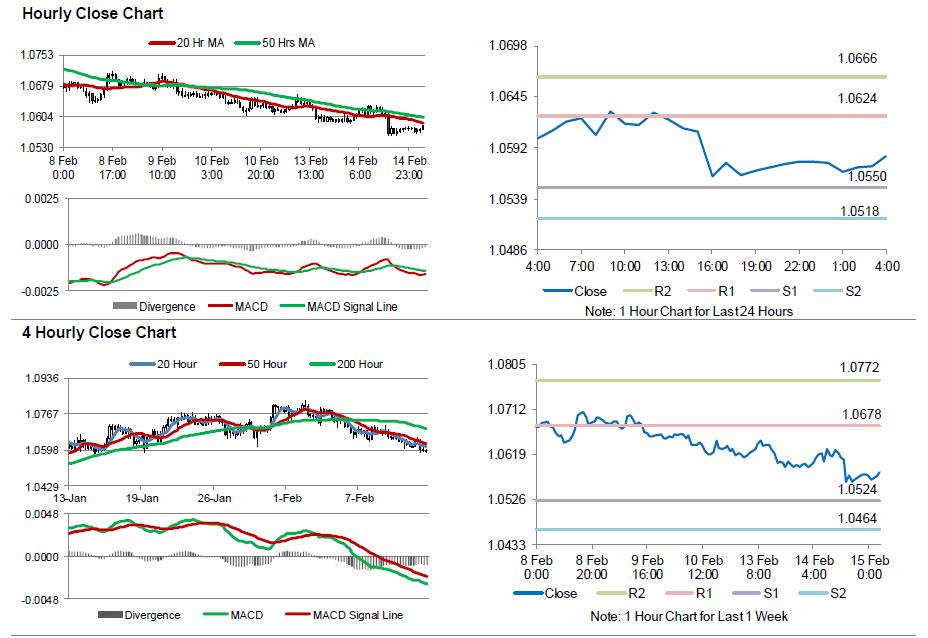

The pair is expected to find support at 1.0550, and a fall through could take it to the next support level of 1.0518. The pair is expected to find its first resistance at 1.0624, and a rise through could take it to the next resistance level of 1.0666.

Moving ahead, market participants will focus on the Euro-zone’s December trade balance figures, scheduled to release in a few hours. Moreover, a slew of crucial economic releases in the US, namely the consumer price index, advance retail sales, industrial and manufacturing production, all for January, along with the NAHB housing market index for February, all set to release later today, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.