For the 24 hours to 23:00 GMT, the EUR declined 0.06% against the USD and closed at 1.2411.

On the macro front, the Euro-zone’s seasonally adjusted final gross domestic product (GDP) climbed 0.6% on a quarterly basis in the October-December 2017 period, confirming the preliminary print. The region’s GDP had risen by a revised 0.7% in the previous quarter.

In the US, data indicated that ADP private sector employment increased more-than-anticipated by 235.0K in February, reinforcing the view of underlying strength in the nation’s labour market. The private sector employment had registered a revised gain of 244.0K in the previous month, while investors had expected for an advance of 200.0K.

On the contrary, the nation’s trade deficit widened to a more than 9-year high level of $56.6 billion in January, suggesting that trade would act as a drag on the nation’s economic growth. The nation had posted a revised trade deficit of $53.9 billion in the previous month, while investors had envisaged it to widen to $55.0 billion.

Another set of data revealed that consumer credit in the US grew $13.91 billion in January, undershooting market consensus for an advance of $17.65 billion. In the previous month, consumer credit had climbed by a revised $19.21 billion. Meanwhile, the nation’s MBA mortgage applications recorded a rise of 0.3% in the week ended 02 March, after recording an increase of 2.7% in the previous week.

Separately, the Federal Reserve’s (Fed) Beige Book report indicated that the US economy continued to grow at a “modest to moderate” pace in January and February. In addition, it showed that firms across the 12 districts observed widespread labour market tightness that contributed to “moderate inflation”, while many regions noted a pick-up in wage growth since the beginning of the year.

In the Asian session, at GMT0400, the pair is trading at 1.2407, with the EUR trading slightly lower against the USD from yesterday’s close.

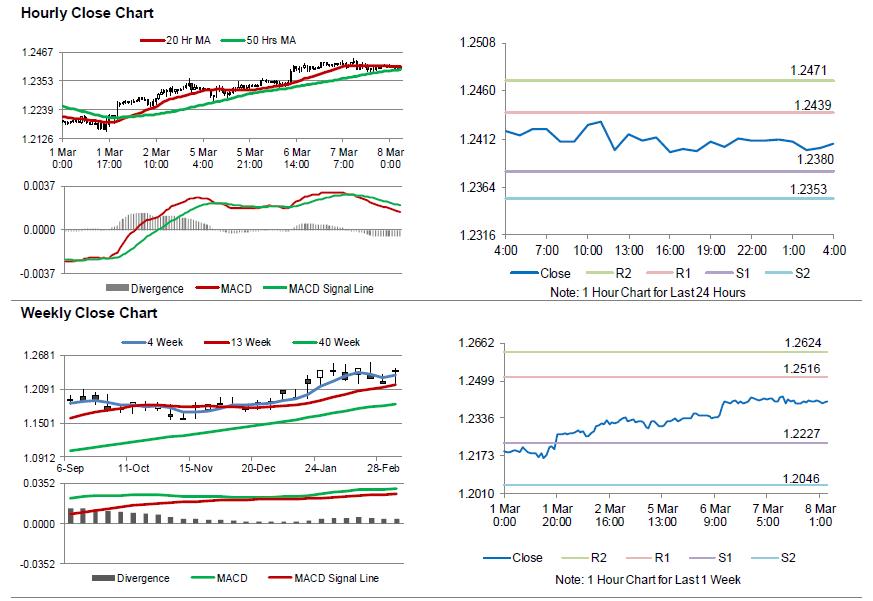

The pair is expected to find support at 1.2380, and a fall through could take it to the next support level of 1.2353. The pair is expected to find its first resistance at 1.2439, and a rise through could take it to the next resistance level of 1.2471.

Moving ahead, the European Central Bank’s (ECB) monetary policy meeting, due later in the day, will be closely watched for further hints on monetary policy as the central bank is widely expected to keep interest rates unchanged. Moreover, the US initial jobless claims data, set to release later today, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.