For the 24 hours to 23:00 GMT, the EUR declined 0.15% against the USD and closed at 1.1301.

Macroeconomic data indicated that, Eurozone’s preliminary Markit services PMI unexpectedly rose to a level 53.1 in August, hitting its highest level in three-months, thus indicating that the common currency region shrugged off Brexit repercussions as growth picked up. Markets expected the index to fall to a level of 52.8, following a reading of 52.9 in the previous month. On the contrary, the flash manufacturing PMI surprisingly dropped to a level of 51.8 in August but was still in the expansion territory, while markets expected it to remain steady at a level of 52.0, recorded in the prior month. Also, the region’s flash consumer confidence index unexpectedly dropped to a level of -8.5 in August, deteriorating for a third straight month and touching its lowest level since April 2016. Markets expected the index to rise to a level of -7.7, compared to a reading of -7.9 in the previous month.

Meanwhile, Germany’s manufacturing sector grew at the slowest pace in three-months, after the flash Markit manufacturing PMI fell to a level of 53.6 in August, at par with market expectations and after recording a reading of 53.8 in the previous month. Moreover, the nation’s service sector eased more-than-expected to a level of 53.3 in August, expanding at the slowest pace since May 2015, thus highlighting that Eurozone’s largest economy lost some momentum. The index recorded a reading of 54.4 in the preceding month whereas markets envisaged for a drop to a level of 54.3.

Elsewhere in the US, the flash Markit manufacturing PMI data indicated that activity in the US manufacturing sector registered a larger-than-expected drop of 52.1 in August, compared to market expectations of a fall to a level of 52.6 and following a level of 52.9 in the previous month. On the other hand, the nation’s new home sales unexpectedly rose by 12.4% on a monthly basis in July, reaching its highest level in almost nine years amid robust demand. New home sales recorded a revised gain of 1.7% in the prior month and defying investor consensus for a drop of 2.0%.

In the Asian session, at GMT0300, the pair is trading at 1.1296, with the EUR trading marginally lower against the USD from yesterday’s close.

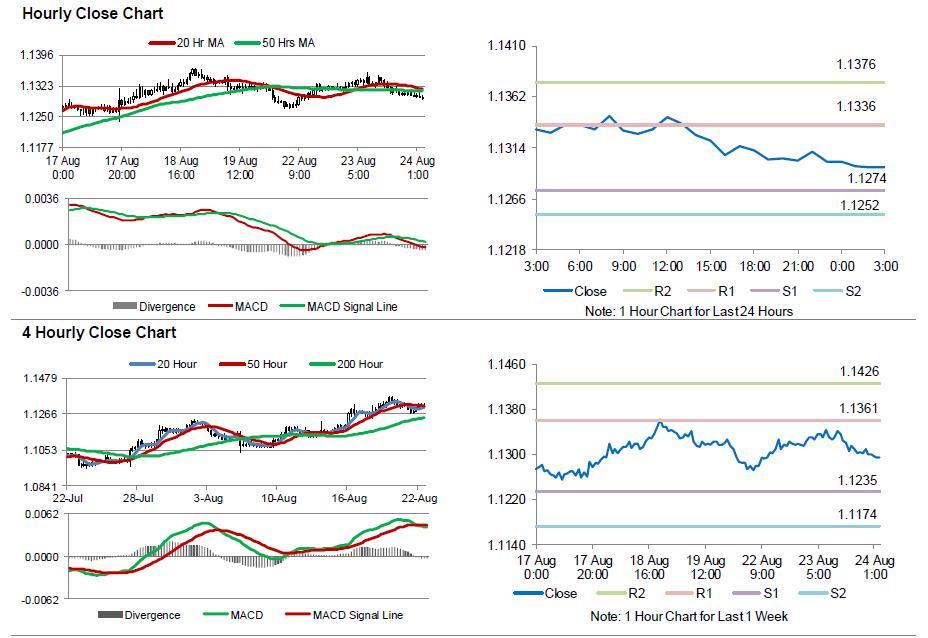

The pair is expected to find support at 1.1274, and a fall through could take it to the next support level of 1.1252. The pair is expected to find its first resistance at 1.1336, and a rise through could take it to the next resistance level of 1.1376.

Moving ahead, investors would look forward to the crucial Germany’s final GDP data for 2Q, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.