For the 24 hours to 23:00 GMT, the EUR rose 0.11% against the USD and closed at 1.11157.

On the data front, Euro-zone’s final consumer confidence index recorded an advance to a level of -6.6 in July, meeting market expectations and confirming the preliminary print. In the prior month, the index had recorded a reading of -7.2. Meanwhile, the region’s economic sentiment indicator eased to a level of 102.7 in July, declining to its lowest since March 2016 and less than market consensus for a drop to a level of 102.6. The indicator had registered a level of 103.3 in the prior month. Moreover, the nation’s business climate indicator fell to a six-year low level of -0.12 in July, compared to a reading of 0.17 in the previous month. Market participants had envisaged the indicator to record a fall to a level of 0.08.

Separately, in Germany, the flash consumer price index (CPI) rose 0.5% on a monthly basis in July, higher than market expectations for a gain of 0.3%. In the prior month, the CPI had recorded an advance of 0.3%. Meanwhile, the nation’s Gfk consumer confidence index fell to its lowest level since April 2017 by 9.7 in August, in line with market expectations. The index had registered a level of 9.8 in the previous month.

The US dollar gained ground against its major peers, ahead of the Federal Reserve’s rate decision as well as positive US economic data.

In the US, data showed that the personal income climbed 0.4% on a monthly basis in June, meeting market consensus. In the previous month, personal income had registered a revised similar rise. Likewise, the US personal spending rose 0.3% on a monthly basis in June, in line with market expectations. In the prior month, personal spending had recorded a revised rise of 0.5%. Additionally, the nation’s CB consumer confidence index jumped to a level of 135.7 in July, more than market anticipations for a gain to a level of 125.00. The index had registered a revised level of 124.3 in the prior month. Also, the US pending home sales advanced 2.8% on a yearly basis in June, rising by the most in three months and compared to a rise of 1.1% in the prior month. Market participants had envisaged pending home sales to record an increase of 0.5%.

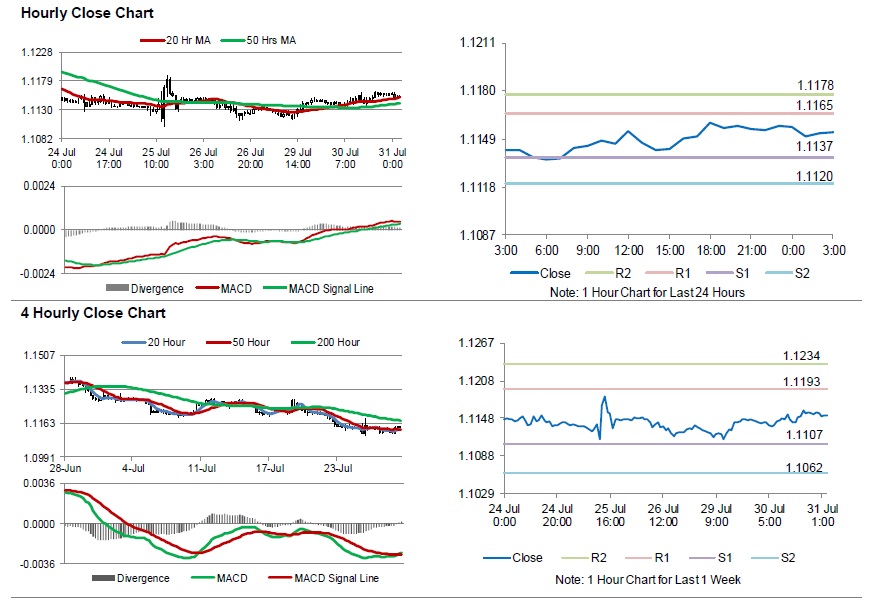

In the Asian session, at GMT0300, the pair is trading at 1.1153, with the EUR trading a tad lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1137, and a fall through could take it to the next support level of 1.1120. The pair is expected to find its first resistance at 1.1165, and a rise through could take it to the next resistance level of 1.1178.

Looking ahead, traders would await Euro-zone’s unemployment rate for June and gross domestic product for the second quarter along with Germany’s retail sales for June and unemployment rate for July, set to release in few hours. Later in the day, the US Federal Reserve’s interest rate decision along with the US ADP employment change and the Chicago Purchasing Managers’ Index, both for July, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.